Who are those guys?

In the movie Butch Cassidy and the Sundance Kid, the charmingly larcenous Paul Newman wonders aloud on several occasions about the Union Pacific Railroad’s expert posse whose relentless pursuit of the bandit-heroes eventually persuades them to try to “go straight.”

(And that leads to another classic line, “If he'd just pay me what he's spending to make me stop robbing him, I'd stop robbing him”—but now I'm sidetracking this chat by hinting at a connection between the movie’s depiction of modernity’s rapid encroachment on the romantic notion of the Old West and the demise of the charmingly free and fun-loving trucker following the Motor Carrier Act in 1980. RIP, Jimmy Carter, the Great Deregulator. For reference, see: lots of anti-establishment movies from the 1970s.)

See also: Independent contractor rules: How did trucking get here?

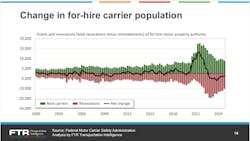

But, back to the point. On the recent 2025 Transportation Outlook webcast, the market analysts at FTR Transportation Intelligence laid out what to expect from the broader economy and freight in the coming quarters (detailed coverage to follow). Among the slides presented by Avery Vise, FTR’s VP for trucking, was a chart featuring the change in the for-hire carrier population.

I was more than a little surprised to see the number of new entrants is still running above the pre-pandemic average—and this comes two years into the worst freight market since the Great Recession. Granted, as the FTR chart shows, the trend in new authorities has been downward since the unprecedented post-Covid peak, and the net change (meaning the difference between carriers coming in and carriers quitting) has been negative since the freight downturn kicked in.

But, still—even now that, as Vise pointed out, the new entrant totals are almost back to normal—who are those guys? Who in their right mind would want to start their own trucking business today?

“I think we've hit bottom [in new entrant levels] for a few reasons,” Vise said. “One is technological: The visibility that we now have through digital freight platforms, to use a catch-all for a much broader area, has made the ability for very small companies—one-, two-, three-, four-truck operations—to get the right kind of freight, quickly.”

Okay, that makes sense, as Vise tends to.

“You also have, of course, the legal constraints that exist—and will exist even under a Trump administration, at least in California—against the leased-on, owner-operator model,” Vise continued.

To which I’d suggest: Not if the American Trucking Associations has anything to say about it.

Vise also noted that used truck prices are “pretty low” and the cost of a truck is among the primary barriers to starting a trucking company.

See also: What are the trucking industry's goals for 2025?

Otherwise, Vise pointed to the “psychological expectation” that “there's got to be a turnaround in freight sometime.” I’d call it the gambler’s fallacy. (And I do have some expertise: Buy me lunch and I’ll tell you about that roulette wheel in Cairo.)

But Vise digs a little deeper, and explained a more subtle, strategic angle.

“One of the factors, because of the whole fraud issue and some other things, is that you have to be in the market a while if you really want to start getting freight volumes,” he concluded. “A lot of brokers have adopted, as a risk management policy, not doing business with carriers unless they have a year of tenure behind them.

“So if you want to take advantage of an improving market, it actually makes sense to get in now—even though the fundamentals don't necessarily look all that strong at this time.”

The trick for new entrants, of course, is to survive that first year—and many won’t.

Here’s my take: Trucking is still seen by a lot of folks as a highway to the American Dream. Ambition, skill, hard work, and fortitude mean a lot in this business. Results, not college degrees, are the primary qualifications and the bottom line.

Competition makes the industry better—as long as everyone plays fair. But that’s another topic.

Welcome to trucking, new FleetOwner readers.