Spot truckload rates for reefers take unusual jump

Spot market load availability gained 4.8% during the week ending November 5, 2016 while the number of trucks posted slipped 2.0%, according to DAT Solutions, which operates the DAT network of load boards.

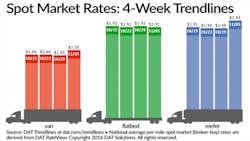

For reefers, rates looked more like the June produce peak than the first week in November, jumping 7 cents from the previous week to an average of $1.97/mile. Reefer rates haven’t been this high since mid-July. At $1.70/mile, the average van rate was up 5 cents week over week and was just 1 cent below year-ago levels.

Reefer and van load-to-truck ratios jumped as well:

•Reefer L/T ratio—6.8, up 13%

•Van L/T ratio—3.0, up 9%

•Flatbed L/T ratio—14.1, down 2%

Reefer trends: With produce and other fresh food moving into position for Thanksgiving, reefer load posts unexpectedly increased 10% the week ending November 5 while truck posts declined 2.5%.

Rates on the top reefer lanes have been hard to predict, with lots of changes from week to week:

•Fresno CA–Denver CO added 27 cents for an average of $2.27/mile

•Miami FL–northern New Jersey added 35 cents for $1.44/mile

•Green Bay WI–Minneapolis MN rose 36 cents to $2.24/mile

•Miami–Baltimore MD was down 29 cents to $1.36/mile

•Los Angeles CA–Denver dipped 18 cents to $2.38/mile

•Ontario–Phoenix AZ rose 7 cents to $3.10/mile

Van trends: Van load posts rose 7% and truck posts dropped 2% the week ending November 5. Price changes were small on most individual lanes, but the overall effect boosted the average linehaul rate to just 1 cent below the average for this time in 2015.

Several van markets are much stronger than they were a month ago, especially markets in the West (Los Angeles, Dallas TX, Denver, Seattle WA, and Stockton CA) that connect the region to much of the East Coast.

The top van markets by region all showed gains:

•Northeast—Buffalo NY, $1.97/mile, up 6 cents

•West—Los Angeles, $2.07/mile, up 4 cents

•South Central—Dallas, $1.51/mile, up 1 cent

•Midwest—Chicago IL, $2.05/mile, up 1 cent

•Southeast—Charlotte NC, $1.91/mile, up 2 cents

Flatbed trends: Flatbed load posts fell 1% the week ending November 5 as truck posts climbed less than 1%. That caused the load-to-truck ratio to drop nearly 2% to 14.1 loads per truck. The average flatbed rate lost 1 cent to $1.91/mile.

The national average price of diesel dipped a penny to $2.47/mile compared with the previous week.

Rates are derived from DAT RateView, which provides real-time reports on prevailing spot market and contract rates, as well as historical rate and capacity trends. All reported rates include fuel surcharges.

Get the latest rate trends at www.dat.com/trendlines.