Torc’s commercialization plans include fleet-focused self-driving Cascadias in 2027

ALBUQUERQUE, New Mexico—Hundreds of miles from most of its competitors, Torc Robotics has been working intensely with major trucking fleets to learn what it will take for its autonomous vehicle technology to become a valuable, cost-effective part of the supply chain.

This week, the leaders of the company—which since 2019 has operated as an independent subsidiary of Daimler Truck—laid out plans to commercialize its self-driving technology, which centers around using fleet-specific hubs along freight lanes stretching from Arizona to Georgia.

“There’s the autonomous truck part of this, but it takes a much broader ecosystem—all across the fleet to make sure this is actually a valuable part of the supply chain,” Andrew Culhane, Torc’s chief strategy officer, told FleetOwner during a visit to the company’s testing center.

The self-driving company was founded nearly two decades ago by Virginia Tech graduate students who made a name for themselves by finishing third in the 2007 Defense Advanced Research Projects Agency (DARPA) Urban Challenge. They used a Ford Escape named Odin. Here in the Land of Enchantment, their goals are much bigger.

See also: Fleets begin to get a feel for the future of moving freight

Torc will begin scaling up its autonomous supply chain technology later this decade as it commercializes the technology into something fleets can spec on future Freightliner Cascadias, currently the leading Class 8 model. This is expected as early as 2027, which could be later than some of the technology company’s chief U.S. competitors, who are operating in Texas now with goals to remove safety drivers from operations as early as 2025.

“While the truck is the thing that moves in that middle mile, there’s a lot of things we need to integrate with—such as [transportation management systems] and how that ties into the planners, mission control, dispatchers, and even the hub and yard operations—and how that connects to current fleet operations,” Culhane said.

C.R. England (No. 34 on the FleetOwner 500: For-Hire) is among the carriers testing Torc technology in the Southwest.

“Probably the biggest driver for us was we owe it to our customers to stay on the cutting edge of what the industry offers from a technological standpoint,” Ron Hall, England’s equipment and fuel VP, said during a discussion at the testing center this week. “It’s been fascinating how many customers have approached us as we’ve been running the pilots, wanting information on what the opportunity for them is.”

Hall said another reason C.R. England joined Torc’s advisory council was to understand better how AV technology will affect truck drivers. He said self-driving trucks could help the carrier’s reefer fleet fill out routes in areas where it is more difficult to hire drivers.

“We also wanted to make sure we could have frank discussions with our drivers about what this means to them. We don’t see this as displacing driver jobs. We see this as enhancing our network to the point where we can improve driver jobs and expand in areas where drivers are hard to find.”

How Torc plans to scale up its autonomous offerings

Culhane shared Torc’s 2027 driver-out commercialization rollout strategy with U.S. and German journalists visiting the company’s test center a mile south of the “Big I,” the local nickname for where Interstates 25 and 40 meet.

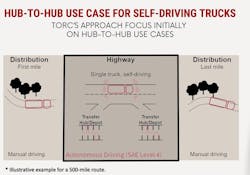

Culhane said Torc will first focus on developing a scalable hub-to-hub platform that can be deployed on freight lanes beginning in Texas, stretching west to Arizona, north to Oklahoma and Missouri, and east to Tennessee and Georgia. But before that, the company will continue working with fleet customers to optimize the autonomous platform for their needs. It is also working to build trust with regulatory bodies and the public.

See also: The humanless difference: Autonomous efficiency goes beyond fuel savings

“Customers should know that this technology will only be released when we have validated and proven that it's safe to do so,” Joanna Buttler, head of Daimler Truck's global autonomous technology group, told FleetOwner. “And along the way, we also want to validate and prove that there is a business case for them and it actually will fulfill its promise of higher asset utilization, higher freight efficiency, and ultimately also improving safety.”

Between now and 2027, Torc plans to continue developing its Virtual Driver and self-driving truck platform while also validating its hub-to-hub total cost of ownership model. The company's commercialization plan would roll out in three phases over the next few years:

- MVP Lane: Torc will initially focus on developing a lane along Interstate 35 between Dallas-Ft. Worth and San Antonio (and eventually to Laredo and the Mexico border) that can be used to prove the economic viability of self-driving trucks. Torc would operate a small fleet of trucks and hubs to support customer onboarding in this phase.

- Transition & Expansion: Torc will help customers transition to a model in which they own dedicated autonomous trucks. Fleet customers and partners will be involved in autonomous hub network expansion to the north, east, and west along much of I-40.

- Continuous Growth and Delivery: Torc will continuously develop its autonomous product to expand its operation design domain. The company will also support the ecosystem in optimizing operations and capturing more value from the self-driving trucks.

Culhane said most self-driving routes would be at least 250 miles and could extend up to 1,000 miles between hubs.

“But a lot of it depends on the network design,” he explained. “That’s kind of the neat thing here—there’s no one version of this map. A lot of operations work differently. A lot of people have optimized their networks for 250-mile hauls. So how do we make sure we’re designing a product that supports that?”

Optimizing a mature industry

The hub-to-hub model would be supported by human-driven first- and last-mile operations to and from the transfer hubs and depots. Walter Grigg, Torc’s industry partnership leader, called Torc’s technology “the moonshot of our generation.”

“We are bringing a fundamentally new technology to a very mature industry,” Grigg told FleetOwner during a ride-along on Torc self-driving Cascadia. “A lot of very smart people have worked very hard to optimize it—within all the existing constraints. Autonomy allows it one degree of freedom that has not existed within its current constraints. There are good reasons we have regulations such as hours of service. Autonomy gives us one degree of freedom that’s never existed before.”

Torc's commercialization plan has three principles:

- Economic Viability: The company will focus on developing a product that is economically viable for customers. This will involve understanding the entire value chain of the freight industry, not just the value chain of the truck going down the road.

- Scalability: The company's product must be scalable for various trucking routes. This will involve recognizing that few fleets in the freight industry operate the same way.

- Safety: Safety is an absolute necessity in this industry. The company will work to build and sustain trust with regulatory bodies and the public.

Culhane said his team will continue to validate its technology between now and the launch. For example: “We can operate in the rain today, but do we have enough rain data to say we can do it safely in all sorts of conditions?” he noted. “That last bit is the full validation… There’s a lot of things that need to come together both on our side—but also within what I’ll call the broader ecosystem. That includes customers, that includes both shippers and carriers being comfortable with this.”

Daimler’s Buttler added: “We never said we needed to be first. We want to do it at the right time, at the right speed.”

About the Author

Josh Fisher

Editor-in-Chief

Editor-in-Chief Josh Fisher has been with FleetOwner since 2017. He covers everything from modern fleet management to operational efficiency, artificial intelligence, autonomous trucking, alternative fuels and powertrains, regulations, and emerging transportation technology. Based in Maryland, he writes the Lane Shift Ahead column about the changing North American transportation landscape.