Demand for vans and refrigerated trucks on the spot truckload freight market was exceptionally strong during the week ending Dec. 1, said DAT Solutions, which operates the DAT network of load boards.

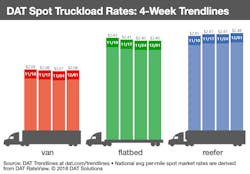

The national average van rate and reefer rate increased 1 cent per mile while the flatbed rate held steady, halting an eight-week decline. Load-to-truck ratios increased for all three equipment types.

As expected, load posts and truck posts increased significantly in a week that follows a holiday-shortened week. The number load posts was up 54% while truck posts gained 21%. Demand is expected to remain strong through the holidays.

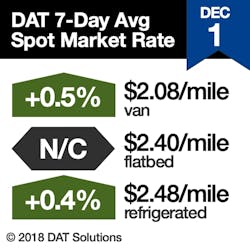

National average spot truckload rates:

- Van: $2.08/mile, up 1 cent compared to the previous week

- Flatbed: $2.40/mile, unchanged

- Reefer: $2.47/mile, up 1 cent

Van trends: Van load posts increased 39% and truck posts increased 23% compared to the previous week. The van load-to-truck ratio rose from 6.4 to 7.2.

Rates were higher on 63 of the top 100 van lanes, including several that are strong for retail freight:

- Columbus to Buffalo, up 31 cents to $3.99/mile

- Philadelphia to Columbus, up 20 cents to $1.84/mile

- Seattle to Spokane, up 31 cents to $3.78/mile

Outbound rates from Los Angeles are 11% higher than they were a month ago, but several lanes declined last week, including L.A. to Dallas, down 24 cents to $2.41/mile.

Flatbed trends: Flatbed load posts skyrocketed 103% last week while truck posts increased 34%. That caused the national load-to-truck ratio to jump from 15.9 to 23.9.

Reefer trends: Reefer load posts surged 46%, more than expected when going from a holiday week to a non-holiday week, and truck posts increased 10%. That caused the national load-to-truck ratio to jump from 6.2 to 8.3 loads per truck.

With the holidays approaching, meat and potato-growing regions in the Midwest saw big upticks in reefer volumes, and fresh fruit and vegetables boosted load counts out of California.

The biggest reefer rate increases were scattered on lanes across the country:

- L.A. to Denver, up 29 cents to $3.52/mile

- Elizabeth, N.J., to Boston, up 28 cents to $4.43/mile

- Grand Rapids to Philadelphia, up 35 cents to $3.98/mile

- Dallas to Houston, up 19 cents to $3.05/mile

- Twin Falls, Idaho, to Baltimore—a long-haul reefer lane—gained 24 cents to $3.26/mile.

DAT Trendlines are generated using DAT RateView, which provides real-time reports on spot market and contract rates, as well as historical rate and capacity trends. The RateView database is comprised of more than $57 billion in freight payments. DAT load boards average 1 million load posts per business day.