The U.S. average for diesel was on a rapidly accelerating crazy train last year, but it had been on an elevator going down so far in 2023 up until last week. Someone pressed the down button again the week of April 24, as the national average for trucking’s main fuel dropped 3.9 cents to $4.077 per gallon, according to the newest data from the U.S. Energy Information Administration (EIA).

The diesel decline this week follows a slight increase—the first in almost three months—of 1.8 cents to $4.116 per gallon the week of April 17.

See also: Several reports, experts sound trucking economy red alerts

The U.S. average is down significantly, more than $1 per gallon—$1.083—from this time a year ago but trucking probably needs few reminders that diesel above $4 a gallon still sits in the stratosphere. About a year before COVID-19, the average sat below $3—$2.965 per gallon—on Jan. 28, 2019, EIA historical data shows, and well into the pandemic (and depressed demand) for the week of Oct. 26, 2020, the national average was $2.385 per gallon, according to EIA.

The U.S. average for gasoline, on the other hand, stayed in virtually the same place the week of April 24, according to EIA, falling a fraction of a penny to $3.656 per gallon after shooting up 6.7 cents the week of April 17. Gas did rise in many regions, however, according to EIA. AAA’s U.S. average for regular gas also was up a fraction of a penny over last week to $3.667 per gallon while a third national measure from GasBuddy was flat compared to last week at $3.66.

Diesel down in every region but one

The only area of the U.S. measured by EIA to see a diesel fuel increase this week was the Rocky Mountain region, where the fuel rose 2 cents to $4.124 per gallon. In every other region, the fuel was down, except the West Coast, where on April 24 it was exactly where it was the week of April 17: $4.692 a gallon. On the East Coast, trucking’s main fuel fell 4.7 cents to $4.151. In the Midwest, the fuel fell 4.3 cents to $3.984 per gallon, and it also dropped 5.3 cents to $3.823 along the Gulf Coast.

See also: Cutting taxes could cut emissions faster than imposing EVs on fleets

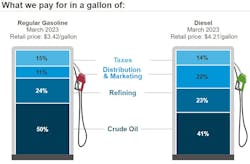

The per-barrel price of crude oil, which diesel and gasoline, as well as other fuels, are refined from, can be a reliable barometer—not including other variables such as demand for fuel and supply as well as OPEC’s influence—is holding steady, with West Texas Intermediate (WTI) hovering below $80 and Brent crude flying just above $80 with some variations. Futures (where speculators think the price will go in the near future) for WTI, for example, are holding at around $77.87 per barrel, EIA showed on April 21, down $4.65 from the week earlier and $25.92 per barrel from a year earlier.

U.S. diesel supplies are tightening but fears of a shortage have subsided, according to an April 23 report from Reuters. It's a widespread downturn in the consumption of fuel caused by slowing manufacturing and freight activity since the third quarter of last year that also is contributing to falling fuel prices, according to the same report. The volume of distillate supplied to the domestic market in January 2023, a proxy for consumption, was the lowest for the time of year since 2017.