Average rates decreased month over month and year over year, freight volumes fell in a similar pattern, and unemployment in transportation is rising. Despite this, June's for-hire trucking reports bear good news. Rates and volumes are showing promising improvements that suggest the freight recession is nearing its end.

Here are key findings on average freight rates, overall freight volumes, and transportation unemployment in June.

Per-mile rates showing promise

For-hire fleets’ average rates show signs of steady improvement.

Rates are still degrading—but in terms of year-over-year degradation, these rates are doing noticeably better than the past few months.

Positive signs for the industry

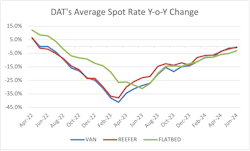

DAT Freight & Analytics found hopeful news for rates in June. Overall, average rates across all equipment types in the month were down year over year—but some days of the month saw year-over-year rate positives.

“We saw several days where rates were, on a year-over-year basis, positive for the first time in over two years,” Ken Adamo, chief of analytics for DAT, told FleetOwner.

For the dry van segment, DAT found that total spot rates averaged $2.07, up 3% from the previous month and down only 1 cent from last year. Meanwhile, average dry van contract rates reached $2.44, up 1 cent from last month and down 6% from the previous year.

Average refrigerated spot rates hit $2.45, up 2% from last month and down 1% from last year. Refrigerated contract rates saw similar changes while averaging $2.81, up 1% month over month and down 2% year over year.

Flatbed spot rates suffered the most in June at $2.53, up 1 cent from May but down 3% from last year. Contract rates fared no better at $3.14, down 1% month over month and down 3% year over year.

“Flatbed is highly dependent on both commercial and residential construction,” Adamo told FleetOwner. “As I’m sure all of us are very well aware, interest rates and general inflation have made that much more stingy as a source of freight.”

Interest rates and inflation have pushed down new home sales and consumer sentiment, while unemployment has steadily increased since mid-2023. These conditions offer headwinds that will slow down freight’s recovery, particularly for flatbed.

See also: Latest freight index: The start of recovery?

The average spot rates’ year-over-year declines might actually be good news: They are some of the weakest y-o-y drops in two years.

“Being positive or flat year over year has actually been a win. Coming into the month, we were 26 straight months of year-over-year decline,” Adamo said. “We were really happy to see that year over year flat ... It really means that the freight cycle is about to enter into its next macrocycle. I think that’s really a positive sign for the industry as a whole and it’s being supported by a lot of other indicators beyond just rates and volume.”

June's average dry van spot rate saw the smallest year-over-year decline since June 2022. The average reefer spot rate was the smallest y-o-y decline since April 2022. Flatbed’s was the smallest since August 2022.

Contract rates generally lag behind spot rates, so it might take some more time to look like they’re exiting the cycle’s trough.

“They’re pricing it with the sentiment of the market they’re exposed to at that moment, for some period six to 12 months in the future,” Adamo said. “I think the contract rates will certainly take a few more months to bottom out and start to look flat to positive, just because it’s an artifact of buying forward versus buying now.”

The longest down cycle on record

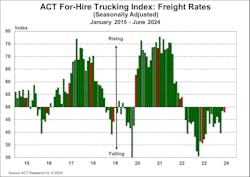

ACT Research’s For-Hire Trucking Index for freight rates, measuring the rate of change for seasonally adjusted rates among surveyed for-hire carriers, fell 0.6 points in June to 47.9. Scores below 50 in ACT’s index indicate degradation, meaning that freight rates continued to fall at a modest rate.

ACT’s Rates Index has consistently scored below 50 since 2022, making this the longest down cycle on record. According to ACT, excess capacity additions by private fleets have helped extend this down cycle among for-hire fleets.

ACT’s Capacity Index, meanwhile, found that for-hire fleets continued to lose capacity in June. The Capacity Index scored 49.3 in June. This is the 12 month in a row of declining capacity, the longest streak since ACT began the capacity survey in late 2009. The index increased by 3.6 points from the previous month, suggesting that for-hire capacity contractions are occurring at a slower rate.

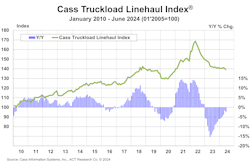

Cass Information Systems' June Index Report found a similar trend for rates. The Cass Truckload Linehaul Index, which gauges both spot and contract per-mile truckload linehaul rates, was 138.9. This was a decrease of 1% month over month and 2.4% year over year.

Cass’s report noted that the freight market is still influenced by overcapacity though rates remain only slightly above late 2023’s lows.

For-hire freight volumes still down

The volume of freight moved among for-hire fleets continues to trend down year over year. However, volumes are still making steady, modest improvements as the freight recession seems to clear.

DAT Freight & Analytics found overall year-over-year declines for its Truckload Volume Index, which gauges loads moved in the spot market during a given month. The dry van and flatbed indexes both fell, while the refrigerated index rose from last year.

DAT’s TVI for the dry van segment was 266, down 9% month over month and down 3% year over year. The refrigerated TVI was 199, down 12% from the previous month but up 7% from the previous year. The flatbed TVI was 279, down 8% month over month and down 5% year over year.

“June is typically that seasonal peak heading into the 4th of July. It’s the culmination of all the spring activity on the dry van and refrigerated side,” Adamo said. “We typically expect, on a monthly basis, June to be one of the stronger months if not the strongest month of the first half of that calendar.”

The refrigerated spot segment not only scored a higher TVI than June of last year but also surpassed all of 2023’s refrigerated TVI scores. Reefer’s highest DAT TVI score in 2023 was in March and October at 196. So far in 2024, the segment’s TVI was higher than 196 for every month except February, which scored 195.

ACT Research’s Volume Index, meanwhile, was 48.9. This seasonally adjusted measure of freight volumes was down 5.5 points from the previous month. Overall, the first half of 2024 averaged a volume index score of 48.8, which is an improvement over 2023’s first-half average of 42.8.

ATA: freight tonnage moving ‘in the right direction’

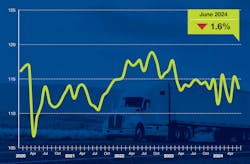

The American Trucking Associations' Truck Tonnage Index, which measures seasonally adjusted for-hire freight volumes, decreased 1.6% in June to 113.5. June’s index score was also down 0.4% from the same month last year.

“While giving back some of the gain from May, it appears that truck freight tonnage is slowly going in the right direction since hitting a recent low in January,” said Bob Costello, ATA’s chief economist. “Despite June’s decline, the second quarter average was 0.2% above the first quarter and only 0.2% below the second quarter in 2023, which are good signs that truck freight might be finally turning the corner.”

The Truck Tonnage Index, based on ATA member surveys, mostly represents contact freight and some spot market freight.

Transportation unemployment on the rise

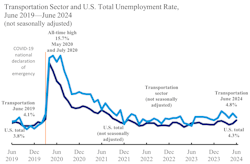

The Bureau of Transportation Statistics’ dashboard for Unemployment in Transportation found that the transportation sector’s unemployment rate rose in June—and is higher than overall U.S. unemployment. Overall transportation unemployment in June reached 4.8%.

This 4.8% unemployment rate is worse than comparable past years for transportation. This month last year, the transportation unemployment rate was down to 3.3%. In the pre-pandemic June 2019, transportation unemployment was 4.1%. This year’s June rate is still well below unemployment seen during the COVID-19 pandemic, where it reached an all-time high of 15.7%.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.