Truckers might not like the federal motor fuels tax that supports American highway infrastructure—but long ago decided it's better than the alternatives, such as tolls and weight-distance taxes.

So, with electric vehicles riding the roads for free—and in increasing numbers—the American Trucking Associations' Highway Policy Committee wrapped up its recent meeting at the ATA Management Conference & Exhibition with a discussion of the most effective way to assess user fees to support roads and bridges for the electrified future.

The preceding presentations made it clear that a fair and efficient solution could be hard to come by.

Jana Jarvis, Oregon Trucking Association president and CEO, appropriately was the first to comment. Her state launched a voluntary vehicle-miles traveled (VMT) program, OReGO, in 2015 and has had a weight-mile tax for trucks since 1933.

"I'm from Oregon, the only state that has 84-plus different weight classifications and configuration rates, with an agency that cannot begin to assess what the evasion rate is in our weight-mile tax," Jarvis said, using the polite term for "cheating."

See also: Pick your poison, truckers: Flat VMT fee, efficiency-based, or weight-based?

"So this whole system works well on paper, but I cannot get our DOT to tell me what the cost of collection is," she said. "I have a pretty good idea it's well in excess of 20%. The cost of a collection for a fuel tax is 0.5%, which means you have to raise the rates higher to get the same revenue and to support whatever it is you're supporting.

"And, in Oregon, we have an obligation to pay our 'fair share,' and lately, the calculations have shown we're overpaying by 32%. So, to get the rates changed, I have to go back to the legislature and get that corrected. This is very complicated."

Discussion moderator Patricia Hendren, executive director of Eastern Transportation Coalition, noted that the Oregon weight-mile system is often cited as "the worst example" of such fees, "followed closely by New York."

"So how do we make sure those aren't the models that now are [implemented] across the entire country?" Hendren said.

Nevada Trucking Association CEO Paul Enos agreed that evasion and cost of collection are problems for any mileage-based fee assessment.

Enos cited a report from the American Transportation Research Institute that found replacing the federal fuel tax with a VMT tax assessed on 272 million private vehicles could result in collection costs of more than $20 billion annually—or 300 times higher than the federal fuel tax.

"It's going to cost 40 cents to collect $1 based on VMT compared to 3 cents now," Enos said. "So where does that 37 cents go? It goes to Silicon Valley, it goes to banks—instead of going to our roads, instead of going to those things that we want the government to do in an efficient way. We're now giving it to people who are taking this grift, and that isn't going to benefit us as citizens."

However, if a VMT program could be implemented that is fair, protects taxpayer privacy, and comes in at a collection cost comparable to the gas tax, then "that's a different conversation," he continued. Except it's not going to happen.

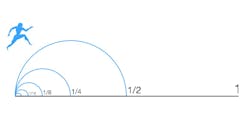

"We're looking at taking an extremely efficient system now and replacing it with something that is as complex as a Rube Goldberg cartoon," Enos said. "If we would have invested $50 million to pilot a program to look at how we can tax electricity in the same way that we tax fuel, maybe we'd be in a much better space today."

And that's the challenge, as Tony Bradley, Arizona Trucking Association president and CEO, discussed. He referred to a slide that suggested the gas tax was "broken."

"It's not broken. The one thing that wasn't brought up is political courage," Bradley said, referring to the U.S. Congress and decades of unwillingness to raise the federal motor fuels tax to keep up with improved fuel efficiency and rising road construction costs. "Let's come up with ways to model VMT after the gas tax—because that's the way forward."

See also: Cutting taxes could cut emissions faster than imposing EVs on fleets

Bradley supports a tax on electricity rather than a flat fee on heavy-duty EVs.

"You can do a kilowatt-hours tax on heavy trucks because of the charging infrastructure that is needed for them," he said. "Who cares about the different variables? The same thing happens now with propane and natural gas: You look at what the output is against diesel, at the diesel-gallon-equivalent of the kilowatt hours, and have the electric companies pay the fee—for heavy-duty trucks, we can do that."

Oklahoma Trucking Association President & CEO Jim Newport serves on the state's Road User Charge Task Force and noted he's the only trucking representative among the 20 or so members. He echoed earlier comments.

"The cost of collection is expensive—and I've given that material to everybody that will listen," Newport said. "You can't just say, 'EV is it, and we're going that way, period.' You can't build that many trucks, and you don't have the grid. It's a little bit offensive, to be honest. And now taxation on top of that.

"I'm hoping that we can do an Oklahoma version, whatever that might be, and not just have to follow this same rote path. This group [ATA] also has been petitioning Congress for years to increase the diesel fuel tax, and they don't have the courage to do it. And so here we are."