Private fleet benchmarking survey reports growth and efficiency

A new industry benchmark survey makes it clear that private fleets are growing, as 122 companies submitted data for the National Private Truck Council’s annual benchmarking survey. This is the most company submissions the NPTC has received since the survey began in 2005. The survey also included the highest number of first-time contributors (28% of total participants) compared to previous years.

Private fleet growth highlights:

- Private fleets now make up nearly half of the truck market

- Private fleets have reported 10 consecutive years of YoY growth

- 44% indicated a net gain in heavy-duty fleet population

- 35% report an increase in terminal locations

Due to this accelerated growth, private fleets now make up nearly half of the truck market. Of the Federal Motor Carrier Safety Administration’s more than 2 million truck registrations, for-hire truck fleets account for about 1 million registrations and private fleets make up roughly 940,000, Gary Petty, NPTC president and CEO, said during a media briefing of the survey results.

Petty also referenced private fleets that began from scratch that have found success and show no signs of slowing, such as Dollar General, Procter and Gamble, and Chick-fil-a.

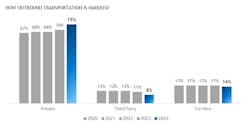

Further, private fleets now carry 75% of outbound shipments.

“That’s an all-time high,” Tom Moore, executive VP of NPTC, said in the media briefing. “We percolated around the two-thirds mark for the history of the survey, and then it was kind of interesting. During the final year of the pandemic, I think a lot of our members started to sense the need [to develop their own fleet] because they couldn't access commercial for-hire capacity. They needed to expand their private fleet.”

Private fleet growth

Private fleets have experienced year-over-year gains in multiple areas over the last 10 years, according to the report.

“Over the last 10 years, private fleets have reported 10 consecutive years of growth in shipments, volume, and value,” Moore said. “It's not always as high as the previous year, but it's always in the positive territory.”

Underscoring this growth, 44% of survey respondents indicated a net gain in their heavy-duty fleet population during 2023.

The necessity or benefit of these private companies having control over their supply chain could be driving the growth, Moore speculates.

“And we believe this growth really reflects not only the favorable winds that are blowing through the economy and the business community during the year 2023,” Moore stated, “but it also reflects the fact that companies are leaning on their private fleet, their in-house transportation, if you will, to strengthen the control over that supply chain.”

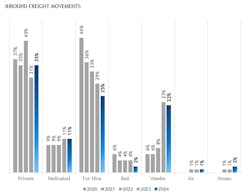

The COVID pandemic accelerated this need for supply chain control, causing NPTC members to develop their own fleets, handling both inbound and outbound shipments, simply to ensure their products remained on store shelves or ensure they were able to manufacture their goods, Moore said.

Packaging Corporation of America, a paper and cardboard manufacturer, found this to be true, Cassie Wood, the company’s transportation manager, explained in the briefing.

“What we found during the tight market conditions was that we had to take control over some of our inbound,” Wood said. “We can't make boxes without the raw material.”

See also: Startup automates international supply chain security

Another aspect of the pandemic that spurred the growth of private fleets boiled down to the costs of transport.

Brakebush Transportation, Inc. saw the value proposition of running its own fleet during the pandemic, when for-hire fleets—that once charged $5,000 for certain loads—now wanted $15,000 for the same load, Brakebush Transportation’s general manager, Mike Schwersenska, said during the briefing.

"The couple of years around COVID ... really made the value proposition of the private fleet pretty apparent,” Schwersenska said.

See also: A private fleet 180 years in the making

More terminals, greater efficiency

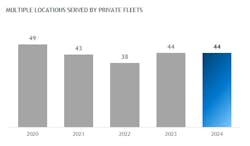

As these companies saw the benefits of running an in-house fleet, many began focusing on ways to improve fleet efficiency. One such area of efficiency improvement for 2023 was to move closer to customers, Moore said. Moving closer to customers reduces the length of hauls and allows more time for drivers to be at home, the report states.

The survey report highlights this strategy. Only 3% of survey respondents operate out of a single location, compared to last year’s 14%. More than a third of respondents (35%) report an increase in terminal locations with the reasons being: business growth (56%); private fleet expansion (20%); acquisition (19%); and to create a driver-friendly network (2%).

One major way being closer to customers increases the efficiency of the fleet is through reduced fleet mileage.

“We're absolutely seeing lower annual mileage,” PCA’s Wood said. “We've really switched to more of the local, dedicated driver ... and that's a big part with driver retention ... As a result of that, we are seeing lower miles year over year.”

This is the first part of a two-part series on NPTC’s annual benchmarking survey. Read part two here.

About the Author

Jade Brasher

Senior Editor Jade Brasher has covered vocational trucking and fleets since 2018. A graduate of The University of Alabama with a degree in journalism, Jade enjoys telling stories about the people behind the wheel and the intricate processes of the ever-evolving trucking industry.