This is part of FleetOwner's Fleets Explained, a Trucking 101 series to break down aspects of the trucking and fleet management industries. You can read more from the series, launched in May 2024, at fleetowner.com/fleets-explained. To submit topic ideas, clarifications, and corrections, email [email protected].

The price of fuel is one of the largest expenses for commercial carriers—and one of the most volatile.

Diesel is by far the primary fuel type for heavy-duty vehicles, powering 97% of Class 8 trucks in 2022, according to research by the Engine Technology Forum.

The price of fuel, particularly diesel, is subject to a complex and ever-changing supply chain. Diesel prices jumped up and down by 20% over a few months in 2023 alone, thanks to innumerable shifts in supply and demand.

How fuel prices affect fleets

Fuel is one of the most expensive factors in running a fleet.

From 2014 to 2023, fuel prices made up 24% of a motor carrier’s per-mile operating costs, according to the American Transportation Research Institute. Costing roughly 55 cents per mile, it is the second highest per-mile cost for carriers—surpassed only by driver wages, which averaged 78 cents per mile.

Diesel is not the only fuel

Diesel may be the dominant fuel in trucking, but Class 8 engines come in several other combustion flavors:

- Compressed natural gas,

- Propane,

- Biodiesel, and

- Renewable diesel

The U.S. Department of Energy currently hosts an alternative fueling station locator, helping fleets find fuel for alternative powertrains. The locator is powered by the National Renewable Energy Laboratory, which provides an interface for carriers to automatically query its database for precise station information.

Fuel prices are, understandably, a top concern for the trucking industry. When fuel prices spiked after Russia invaded Ukraine in 2022, the issue was No. 1 in ATRI’s 2022 annual report on top trucking concerns and No. 3 in ATRI’s 2023 report (more on how geopolitics affect prices below). While the issue fell off the overall top 10 list in the institute’s 2024 report, commercial drivers ranked No. 8.

What is a fuel surcharge?

Roughly a quarter of the cost of operating a truck depends on a highly volatile market, so carriers’ load contracts tend to account for this with the fuel surcharge. A fuel surcharge is an additional fee, separate from the agreed freight rate, that changes depending on current fuel prices.

According to the Owner-Operator Independent Drivers Association, the fuel surcharge tends to be a fraction of the pump price—a roughly 1-cent surcharge for every 6-cent increase at the pump. The association said the agreed freight rate should cover most of the cost of fuel, with the surcharge making up for unexpected price fluctuations.

What are fuel prices based on?

Like all markets, the price of fuel relies broadly on supply and demand. Too much available fuel can drop prices, while seasonal spikes in demand can make prices surge.

Diesel fuel also relies on an extensive supply chain. Several businesses harvest crude oil from the earth, refine it into diesel, store the fuel, and distribute it to fuel stations. Disruptions in any of those markets can affect the final price at the pump.

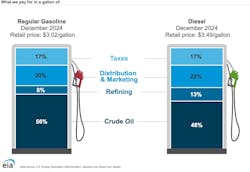

The main components in fuel pricing are taxes, distribution and marketing, refining, and crude oil, according to the Energy Information Administration. The cost of crude oil, making up roughly half the price of diesel at the pump, is the most volatile component of fuel prices.

Trucking is one of the largest sources of diesel demand. The U.S. transportation sector—including trucks, trains, boats, and barges—consumed about 125 million gallons of diesel per day in 2022, according to EIA. Transportation that year accounted for 75% of the nation’s total diesel consumption and 15% of its total petroleum consumption. With trucks moving most of the nation’s freight, motor carriers make up a significant share of national diesel demand.

Taxes

On average, state and federal taxes make up about 15% of diesel’s pump price.

Federal fuel taxes have remained unchanged since 1993: The government charges 24.4 cents per gallon of diesel fuel.

State taxes, however, vary. Each state adds its own taxes and fees to a gallon of fuel. A state’s tax can be either a percent of the sales price or a flat per-gallon charge.

According to EIA, in January 2025, the average diesel state diesel fuel tax was about 35 cents per gallon; the highest state tax was California’s at 92 cents per gallon; and the lowest state tax was Alaska’s at about 9 cents per gallon.

Taxes are not the only way that governments influence fuel prices. Environmental regulations, national strategic reserves, and international trade policies can disrupt any part of diesel’s supply chain, further changing costs.

Market speculation

“Supply and demand” is a simple phrase but underrepresents an important part of fuel pricing. Market sentiments and perceived risk play a large part in costs across every step of oil production and distribution.

The perceived values involved in crude oil trading can significantly influence oil prices and, subsequently, the price at the pump. The two major crude oil indicators are the prices of West Texas Intermediate Crude Oil futures and Brent Crude Oil futures.

A common perception is that geopolitical events raise fuel prices. This is particularly common when oil-producing countries are involved. Russia’s invasion of Ukraine caused crude oil prices to rise by upwards of 50%, according to authors in Humanities and Social Sciences Communications. This contributed to skyrocketing fuel prices in 2022 which caused carriers’ operational expenses to jump by 21%.

WTI and Brent prices tend to spike after major conflicts because players in the oil market fear for the future availability of oil, thereby driving demand, according to authors in the Journal of Futures Markets.

However, that spike does not remain for long. Authors writing for the European Central Bank found that Brent prices returned to normal after eight weeks of Russia’s invasion. The ECB authors found that, in the long term, oil prices often remained weak after demand dampened.

How to follow fuel prices

Fleet executives may monitor fuel prices at their most frequent fueling stations or monitor national prices to make strategic business decisions. Every fueling station has its own way of determining prices but tends to follow regional trends.

EIA and AAA are two popular groups reporting regional and national pricing trends. Both organizations publish regular gas and diesel pricing updates. FleetOwner covers weekly pricing trends both nationally and by region.

For particular stations, several technology companies can empower fleets to track diesel prices at specific pumps or along key routes.

About the Author

Jeremy Wolfe

Editor

Editor Jeremy Wolfe joined the FleetOwner team in February 2024. He graduated from the University of Wisconsin-Stevens Point with majors in English and Philosophy. He previously served as Editor for Endeavor Business Media's Water Group publications.