Convoy is a Seattle-based startup with the modest aim of “reinventing the $800 billion trucking business,” or so says the first line of its news release. Convoy is led by a pair of Amazon.com veterans with backing from the founder of the giant online marketplace, to say nothing of additional financial support by some key players from Uber, eBay and a top private equity firm, just to name a few. So I gave them give a call to find out just how serious this effort is going to be.

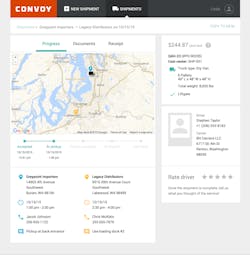

The pitch is straightforward: Convoy is designed to make it easy for shippers to connect with nearby trucking companies on demand, creating efficiencies and helping them book and track jobs instantly. The platform is now up and running in the Seattle-Tacoma area.

“The goal is to use the technical experience a bunch of us on our team have to make a better experience for truck drivers and carriers, in particular independent owner-operators and small truckers,” Founder and CEO Dan Lewis says.

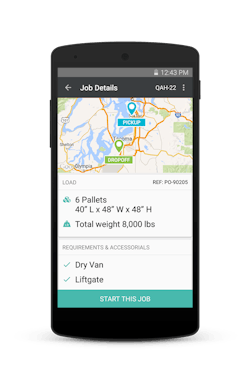

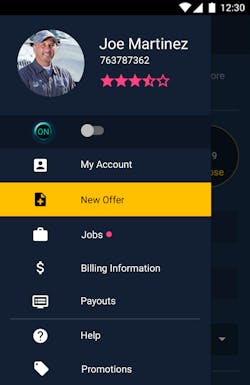

The basic tool is Convoy’s free “simple but pretty powerful mobile app” that sends along a load offers to carriers in the network. But the technology isn’t simply a load board that broadcasts freight opportunities to its members.

Instead, based on the characteristics of the load, the technology selects and notifies the most appropriate available trucker for the job. Proximity, in addition to having the right equipment, is a key consideration. The would-be carrier then has a limited amount of time to review the offer and accept or decline before the offer expires and goes to another carrier in the Convoy network.

“If you try to blast that to everybody at once, people are going to react immediately and accept it without reading the details,” he explains, and any such “feeding frenzy,” along with the risk of cancellation, is potentially unsafe for drivers on the road when they receive the offer. Convoy is working to develop the most “fair” decision window, and Lewis points out that the offer will stand until someone accepts it—the carrier simply loses the exclusive right and the guarantee of the load.

Additionally, the technology sets the price based on algorithms that take into account those load characteristics and prevailing market rates. Variables include the type of freight, assessorials, distance, and pick-up/delivery windows, for instance. It’s up to both the shipper and the carriers to accept the price (although feedback tools are in the works if the pricing comes in significantly higher or lower than expected).

Based on preliminary work with area shippers, the pricing has been coming in just below market rates—but because Convoy’s percentage is much less than that of a broker, the carriers benefit as well, Lewis explains. And no loads have gone unaccepted to date, he notes.

“If we can get this right, this will save a lot of time and reduce the hassle,” Lewis says.

And Convoy offers other benefits, including a load checklist that stores before and after pictures and the bill of lading. Additionally, carriers can rate the shippers. Carrier management also can easily locate all of the trucks in the fleet.

The initial focus is on local and regional shipments, and Convoy currently visits every carrier in the network as part of the carrier screening process.

The goal for the next year is to establish “critical mass” in multiple regions around the U.S. to build the Convoy brand. Looking further down the road, Convoy aims to be “the best option” for local and regional trucking, with the potential “to connect the dots” between regions.

“I’d love to be at the point in five years where our customers are thinking, ‘I don’t know how we did this before Convoy,’” Lewis says.

What’s NEXT?

Chung, who has been a shipper, broker, and a carrier, owns iDC Logistics, which specializes in electronics and delivers approximately 18,000 loads per year, totaling up to $2 billion dollars of merchandise annually. The company ships to big box retailers including Walmart, Target, Kmart, Sears, Costco, Best Buy, JCPenney, and Kohl's.

He designed NEXT Trucking to connect shippers directly with vetted truckers who are willing and able to carry the freight. And, unlike Convoy, the platform is immediately targeting over-the-road trucking.

“We’re trying to eliminate the broker,” he tells Fleet Owner. “We don’t need them anymore. As long as we know the shipper’s and trucker’s needs, we can connect them without paying for the broker.”

Rather than a broker “passing information around,” technology can do it more efficiently—and at a fraction of the cost.

Carriers submit their route and rate preferences on the NEXT mobile app, and shippers post their jobs on the marketplace. Shippers can then see nearby truckers whose preferences match their posted job. Once the shipper selects a carrier, the mobile app notifies the trucker to pick up the freight, and the shipping process begins as usual.

The entire process, including paperwork and payments, is handled by the NEXT marketplace and app. Shipments can be tracked in real-time via GPS. After the shipment is delivered, shippers can rate carriers, ensuring quality standards.

Additionally, NEXT Trucking offers an expedited pay option.

Because of the connection to iDC, NEXT Trucking has immediate access to a base of 2,500 active shippers, Chung notes.

“A trucker’s offer is available just like merchandise on Amazon,” explains founder Lidia Yan, who brings brings online marketing expertise from global e-retailer NewEgg.com. “So shippers go to our website and key in shipping details. The shipper can shop for truckers: He can see the price, the trucker’s history, documents, even previous reviews from other shippers.”

While NEXT Trucking doesn’t set rates like Convoy does, parameters in the system set high and low limits to keep offers reasonable. The point, after all, is to get truckers loads at favorable terms—not to post unrealistic listings.

“Why don’t we create a trucker community? They’re always the underdog,” Yan says. “We really want to gather them together and let them make the call. This is the first app that was designed for them. They are the boss. We give them visibility to the market so that shippers can see them directly. By helping them make more money and get the job they want, we can really stabilize the market.”

About the Author

Kevin Jones

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.

Working from Beaufort, S.C., Kevin has covered trucking and manufacturing for nearly 20 years. His writing and commentary about the trucking industry and, previously, business and government, has been recognized with numerous state, regional, and national journalism awards.