Cutting the costs associated with work absences

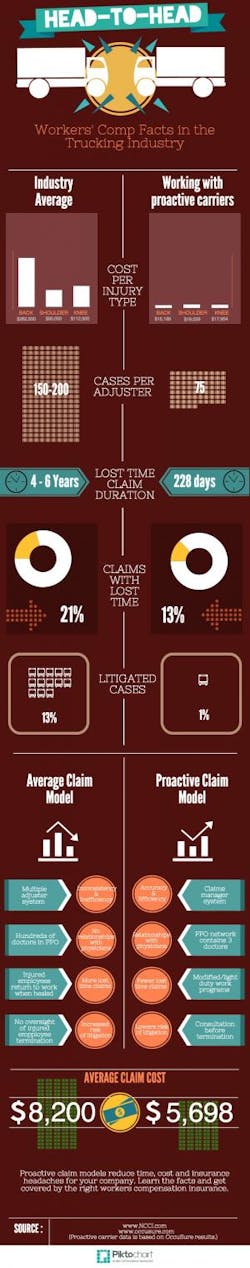

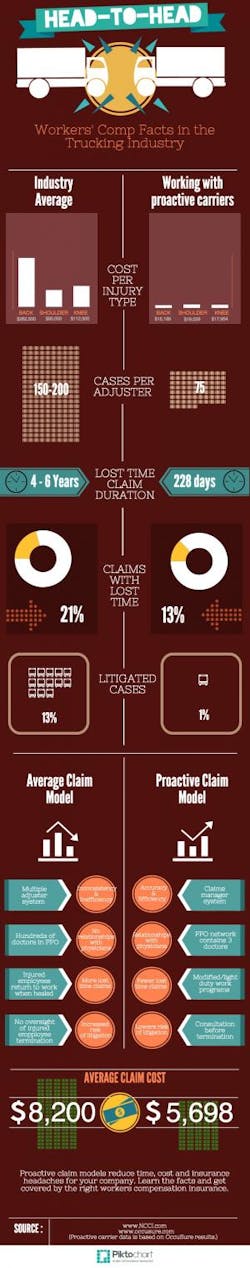

(To see a scaleable version, click the graphic)

But the costs and work-time missed are both items that fleets can control – to a certain extent. According to OccuSure Workers’ Compensation Specialists, a firm specializing in workers’ compensation, trucking fleets can dramatically reduce their risk exposure, and therefore, cost, by being proactive.

This includes setting both policies and programs for employees. According to OccuSure, proactive fleets can see a lost-time claim duration (time out of work) of 228 days vs. as much as 6 years for an “industry average workers’ comp insurance carrier.”

The company also says that its clients with proactive programs face litigation in just 1% of all cases vs. 13% for others. And to illustrate the costs, OccuSure noted that a back injury costs $15,000 vs. $260,000.

The company sent along a graphic (click the image to the left for a larger version) to illustrate its points. Naturally, of course, OccuSure is touting its own services, but there is no doubt that workers’ comp claims are a big issue.

A report just released by the National Academy of Social Insurance, and reported on by the Insurance Journal, notes that workers’ compensation benefits rose 1.3% to $61.9 billion in 2012 (for all companies, not just trucking). Employer costs jumped up 6.9% to $83.2 billion.

Despite those increases, though, (which the Insurance Journal attributed to more people working), the “costs per $100 of covered payroll,” which the Journal says is a better indication of actual costs to companies, have been dropping. Employer costs were just $1.32 per $100 in 2012 while benefits totaled only $0.98 per $100.

(The 86 page report provides state-by-state statistics as well the number of covered works, medical benefits and more. See the full report here.)

So clearly, we are trending in the right direction. But more can be done.

Most insurance companies will work with carriers to reduce the risks of a workers’ comp claim, and there are other companies such as OccuSure who will do the same. For fleets that are self-insured, or anyone else interested in reducing their exposure, OSHA has an entire section of its website dedicated to the issue, including question and answer sections that will help fleets identify their needs, what to include in a program, how to get started and how to train employees.