So I spent last week listening to several U.S. economic and trucking forecasts at the annual transportation conference hosted by research firm FTR – some of it very gloomy, some of it surprisingly not.

On the one hand, Noël Perry, an FTR partner and its resident trucking expert, provided a cautious if not downright worrisome perspective regarding the industry’s near-term future – predicting that freight volumes will continue slumping in the face of gross domestic product (GDP) growth of just 2% for the next two to three years, with a heightened risk of a recession as well.

Bill Witte, FTR’s in-house economist, didn’t offer many happy thoughts in his outlook for the U.S. economy, either; nor did Eric Starks, the firm’s president and CEO, in terms of his forecast for Class 8 production levels.

Yet a striking contrast emerged at the very same conference, courtesy of two other speakers: Steve Latin-Kasper, market data and research director for the National Truck Equipment Association (NTEA), and analyst Jeff Kauffman (who also provided an interesting take on the trailer market).

NTEA’s Latin-Kasper believes we may actually be at the start of a pretty robust spike in freight volumes, actually – especially if “millennials open their wallets,” which he thinks would boost GDP from 2% to 3% next year. He also is a strong proponent that the sluggish freight volumes of late are due to an ongoing “inventory correction” that’s lasted 17 months so far – largely due to stockpiling that occurred last year as a reaction to the big weather-driven capacity shortage experience in 2014.

Latin-Kasper also predicted that “correction” should end in the fourth quarter this year, which would lead to a rebound in freight volumes.

Will that happen? Well TL truck tonnage spiked this August, according to data tracked by the American Trucking Associations (ATA). Could that be an indication that correction is ending? We’ll see.

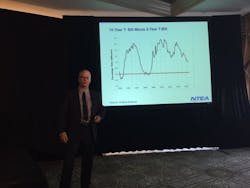

Latin-Kasper also introduced another interesting economic “marker” of sorts: what he calls the “T-Bill inversion point,” when the interest rates on 10-year and 2-year Treasury bonds switch places, which is a dead-on recessionary signal.

According to his data, that so-called “inversion point” is still a ways off – meaning that a recession is highly unlikely in 2017 or 2018.

A more likely problem, in his view, is a labor shortage: something trucking is all-too familiar with at this point.

Daniel Meckstroth, vice president and chief economist for MAPI, also referenced this tightness in the labor market during his overall forecast for the U.S. economy; in his view, we’re at “full employment” as the unemployment rate is below 5%

But in some ways the data doesn’t necessarily match up with those conclusions.

Take a look at this story, dubbed The Invisible American, and one of its scarier numbers: According to the U.S. Bureau of Labor Statistics, the percentage of the total U.S. adult population that has a full-time job has been hovering around 48% since 2010 – the lowest full-time employment level since 1983.

That doesn’t exactly scream “full employment” to me, at least.

Here’s another more worrying long-term trend from that Gallup story: The number of publicly listed companies trading on U.S. exchanges has been cut almost in half in the past 20 years – from about 7,300 to 3,700.

Because firms can't grow “organically,” that is, build more business from new and existing customers, they give up and pay high prices to acquire their competitors.

That acquisition strategy – occurring with some frequency in the transportation and logistics space – is thus drastically shrinking the number of U.S. public companies and thus contributing to a “massive loss” of U.S. middle-class jobs.

Of course, many point out that the stock market is going like gangbusters: that’s a sign of economic health, right? Well maybe not, especially if this analysis is correct

From where Jeff Kauffman sits, while there are definitely “mixed signals” where the economy is concerned – the decline in corporate profits being one of them – he, like NTEA’s Latin-Kasper, thinks an ongoing “inventory correction” is to blame for the current sluggishness in freight markets. Kauffman also believes that once we’re past this correction, freight volumes should increase – upwards by 3% to 4% next year.

“Spot prices are also now above contract prices for the first time, so there might be an ‘upside surprise’ for the [trucking] industry next year,” he added.

Kauffman also stressed that that there’s a silver lining of sorts to the slow recovery experienced during the Obama years – a “recovery” averaging barely 2% GDP.

“That means the U.S. economy has ‘undergrown,’ so the factors that lead to a recession are not really there,” he explained. “In fact the right things are happening to set us up for a better 2017.”

So – will we experience a “better 2017” as Kauffman predicts? Or will gloomier forecasts prevail? We’ll see.