Last week, though, Taylor Robinson and Graham Brisben – president and CEO, respectively, for PLG Consulting – put some greater specifics about the “near-shoring” trend on the table during a conference call with reporters arranged by Wall Street investment firm Stifel Nicolaus. And their take holds out some tantalizing opportunities for trucking if this “near-shoring” or “re-shoring” activity continues to grow.

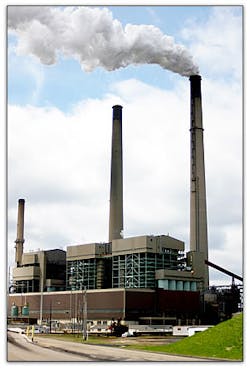

Robinson explained that the big driver for this movement is cheaper energy – specifically natural gas, which he said is four times cheaper than oil on a BTU [British Thermal Unit] basis. Robinson added that natural gas prices seem certain to remain low for the foreseeable future, with the “forward curve” suggesting that natural gas prices will not approach $5 until 2018.

He stressed that the reason the abundance of cheap natural gas in the U.S. is so critical is that direct materials costs make up the lion’s share of manufacturing cost of goods sold – and those costs are highly influenced by the price of energy and input materials.

“Since the proliferation of hydraulic fracturing and horizontal drilling, those input costs have come way down,” Robinson said. “Meanwhile, U.S. industry has become dramatically more productive over the years, and as industry has expanded, it has had to hire few incremental workers as a result of lean and six sigma initiatives. Plus, there are other advantages inherent in local manufacturing, including customer responsiveness and reduced transportation costs.”

OK, but what does all of that translate into in terms of freight potential? Chew on these factoids:

Many of the end products that are produced using chemicals that contain natural gas as a base feedstock are consumer non-durables. So from Robinson’s perspective, such “end products” here include a wide range of consumer non-durables including food packaging, trash bags, diapers, bottles, detergents, medical gloves and clothing – with consumer demand for such items remaining in his words “relatively stable and recession-resistant” relative to historically characteristic of the chemicals industry, when chemicals were more heavily weighted toward durables and automotive.All that being said, though, the manufacturing operations for several product types will likely never move out of southeast Asia, according to Robinson, because entire supply chains for several industries concentrated in that region including: shoes/apparel; fabric/textiles; computers; and electronics. Plus, the Chinese government will continue to subsidize certain industries to avoid relocations.

Still, if this “near-shoring” manufacturing shift continues to grow legs, trucking could be looking at some burgeoning and consistent freight volumes in the not-so-distant future.