I’ve touch on some of the specific trucking regulations now in the works in this space before, but now we’re going to examine a slew of broader rulemaking efforts underway within the Environmental Protection Agency (EPA) that will no doubt side-swipe trucking in some fashion.

Daniel Krohn, a business research analyst with IBISWorld, pulled together a nice synopsis of five major regulatory broadsides about to be fired by the EPA, designed to hold businesses “more accountable” in the agency’s words for their environmental impact.

[As an aside, IBISWorld also put together some good research on budgeting for cold weather maintenance and the transportation winners and losers resulting from falling oil prices; articles any trucking firm will find worth reading.]

Those five EPA-led regulatory efforts revolve around the:

- Clean Air Act (CAA)

- Clean Water Act (CWA)

- Mercury and Air Toxics Standards (MATS)

- Resource Conservation and Recovery Act (RCRA)

- Toxic Substance Control Act (TSCA)

Once the EPA finishes revising elements of those five pieces of legislation, IBISWorld’s Kohn believes prices for a wide assortment of goods and services that the energy, construction and mining sectors provide – including natural gas, paints and coatings and nonferrous metals – are going to increase significantly.

“As a result, businesses that are heavily reliant on such goods and services are likely to see their own operational costs rise as their suppliers pass down cost increases,” he warned. “Businesses should develop a strong understanding of these impending legislative changes and what markets they affect to make better purchasing decisions.”So let’s take a look at what’s going on here.

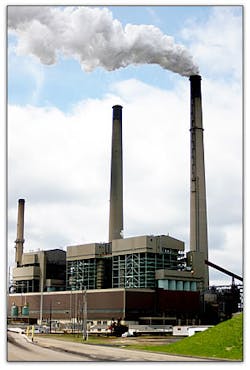

The Energy Sector is expected to take the largest hit from regulatory change in 2015, with the EPA planning to enforce stricter standards for the emissions of greenhouse gases (GHGs), the discharge power plants release into U.S. waterways and the handling of underground fuel tanks. These actions are projected to elevate electricity, natural gas and fuel prices in the upcoming years.

Coal-fired power facilities are expected to be a primary target of new legislation in 2015. An estimated 1,500 power plants in the U.S. are coal-fired facilities that generate nearly half of the country’s electricity. In the process, however, they produce large quantities of pollutants, such as ash and CO2 (carbon dioxide).

Kohn said the EPA is expected to use the authority granted to them under the CAA, CWA, RCRA and MATS to tighten standards regarding emissions and discharge from coal-fired powered facilities and projects the costs of complying with these new standards will contribute to projected 1.5% annualized growth in electricity prices in the three years to 2017. Meanwhile, these standards are expected to stimulate demand for natural gas and, in turn, help push natural gas prices up at an annualized rate of 7% from 2014 to 2017.

[Not something that truckers switching over to natural gas to run their equipment want to hear, I think.]

Furthermore, under the revised regulations to the RCRA, fuel vendors will be required to undergo additional training on the proper operation of fuel storage tanks, update their underground storage leak prevention and detection system with the latest technologies and install systems that run cleaner fuel. These requirements should increase the operational costs of fuel vendors – contributing to a 2.9% annualized rise in gasoline prices and a 1.3% annualized boost in diesel fuel prices in the three years to 2017, Kohn stressed.

[And that isn’t going to be welcome news to truckers sticking with diesel fuel, for sure.]In the Construction Sector, which is highly reliant on painting and demolition contractors, brick and structural clay products, as well as paints and off-highway trucks, upcoming revisions to the CAA are projected to inflate the prices of brick and structural clay products and medium- and heavy-duty vehicles.

Meanwhile, changes to the TSCA will increase the cost of manufacturing paint and call for additional training for painting and demolition contractors.

Specifically, in 2015, revisions to the CAA will strengthen the emission standards imposed on brick and structural clay product manufacturers. These revisions will require brick and structural clay product manufacturers to take additional measures, such as replacing their kiln and dust control equipment more frequently and using cleaner fuels, such as natural gas to reduce their emissions of harmful byproducts.

In turn, these standards are expected to inflate the costs of brick and structural clay manufacturers – moves Kohn projects will to contribute to an annualized rise of 3.4% in masonry and stonework services during the next three years.

Under the CAA, the EPA is also expected to set stricter emissions standards for medium- and heavy-duty vehicles [fuel efficiency mandates designed to reduce GHG emissions] that Kohn believes will force OEMs to invest heavily in research and development and thus push up sticker prices. He expects the need to pay for such investments will help ignite a rise in off-highway truck prices at an annualized rate of 9% through 2017.

Then there’s the Mining Sector, where regulatory-induced medium- and heavy-duty vehicle price pressures is also going to be felt.

Meanwhile, under the CWA, the EPA is expected to extend its influence over the issuance of permits, thereby making it more difficult for mining companies to mine in U.S. waters and wetlands.

Outside of U.S. waters, mining companies are held to stricter standards regarding permitting and reporting when they operate within proximity to a waterway. Upcoming revisions to the CWA are expected to broaden the area surrounding U.S. streams in which mining companies are held to these more stringent standards.In light of these upcoming revisions, IBISWorld predicts that operational costs will rise throughout the mining sector and mining activity will slow, thereby reducing the supply of mined resources and by extension help raise prices.

In particular, the U.S. is a large producer of nonferrous metals such as aluminum, copper, zinc, titanium, lead and molybdenum, noted Kohn, and so price of nonferrous metals will grow at an annualized rate of 6.3% in the three years to 2017, due in part to these upcoming regulatory revisions.

So what does all of this translate into? Well, Kohn emphasized such revisions to key legislation will not only elevate the costs of goods and services within the energy, construction and mining industries; they’ll also indirectly inflate the prices of a wide assortment of other business-to-business goods and services in the coming years.

“Businesses heavily reliant on goods and services from the energy, construction and mining sectors are advised to take the time to evaluate their vendors’ supply chains and use long-term contracts to lock in current prices,” he stressed.

“Moreover, [such] businesses are advised to devote additional time to ensuring vendors comply with new regulatory standards and consider enlisting legal counsel to assist in these assessments,” Kohn added. “Although these precautions will make procurement more expensive, they will protect the buyer from costly EPA-sanctioned penalties and public lawsuits down the road.”

Wow; all of that doesn’t add up to “Merry Christmas” now does it?