After healthy Black Friday and Cyber Monday shopping in the U.S., strong growth in e-commerce is continuing to drive a bigger surge this year in seasonal freight volumes and sales, according to package delivery and logistics giant DHL Group.

"There was 16-18% growth in sales, and we are clearly seeing that in our terminals right now," said Lee Spratt, CEO of DHL eCommerce for the Americas, speaking along with other company execs at a New York press event. DHL expects that pickup and delivery volumes will be up 26% this year vs. last holiday season.

In gauging holiday season sales and resulting freight movement, e-commerce is the dynamic to watch. U.S. online retail sales are set to grow 16% this year to $462 billion, according to DHL, while sales growth at physical retail stores, by comparison, was just 2.6% in 2016.

Factoring out transactions normally not done online like automobile, fuel and restaurant purchases, about 11.7% of U.S. retail sales take place online. That figure is expected to grow to 13.9% of all retail transactions by 2021, representing a total of $789 billion.

As of this year, about 1.7 billion people are shopping online. Globally, DHL expects this holiday season will see some $107.4 billion in online sales.

Ready or not

In ramping up facilities and capacity to handle the seasonal freight volume surge, DHL polls its customers on what they're seeing with sales. After surveying 100,000 U.S. business customers and receiving about 1,400 responses, DHL learned that 45% of businesses expect an increase of at least 10% in e-commerce sales this season.

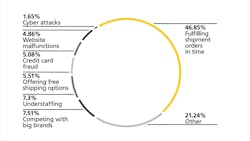

Nearly half of respondents, 47%, said that fulfilling shipment orders in a timely manner is their biggest challenge, but yet 84% said they do not plan to hire any additional staff for the holidays. On that note, Spratt said that as a business trend, seasonal hiring is becoming more difficult.

"As you know, the labor situation in the U.S. market has started to tighten up a bit," he said. "It's becoming more and more difficult to find labor to come in and do the sorting, so we have to be thinking about things like more automation" of warehouses, he pointed out. DHL showcased a number of technologies it's employing to shave down order warehouse/ order processing time.

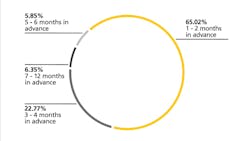

Possibly also related to problems with timely shipment processing, 65% of DHL survey respondents said they do not start planning for the holiday season sales surge until one or two months in advance. Meanwhile, 58% said global trade has increased their sales since the beginning of this year.

In prepping for the holiday season, DHL has added about 6,000 additional people across all its divisions. The company has also increased its number of delivery drivers, is running weekend deliveries and added more intercontinental air freight space to handle the seasonal volume surge, including a Round the World Freighter relief capacity service that will continue beyond seasonal use.

Changing expectations

One of the reasons for the growth in e-commerce, Spratt contended, is that online purchasing is becoming easier. And that's one of the big changes that's occurred over the last five years, he added: "It's become all about customer convenience."

"Five years ago, the perfect logistics model for e-commerce was to put a big, dedicated facility somewhere in the center of the country and ship your products out of that facility," Spratt said. "It [the product] would take 3-8 days to get there, and that was okay with consumers."

Now, however, DHL has found that consumers want e-commerce to be more convenient and fast. About 75% of consumers still want free shipping, the company has found, so that remains a big factor, but a growing trend is toward "EDD," or expected day of delivery.

"They want that transparency," Spratt contended regarding customers receiving a shipment. "Where's my package? When will it arrive? What's the expected day of delivery? That's becoming more important."

The continued expectation of free shipping and a "new norm" of about 2-3 days turnaround time for orders are "really starting to change the landscape of what e-commerce logistics in the supply chain looks like," he said. "It's requiring merchants to get their SKUs closer to consumers."

In other words, manufacturers need to get their products distributed to a greater number of warehouse locations rather than a more central, larger location, which takes more organization. "It makes it so you have to do a better job of inventory management," Spratt noted. "You have less volume of your inventory in more places throughout the country."

To that effect, DHL has expanded its freight warehousing services, which are available at 38 facilities around the United States with 18 new locations opened this year. The company offers "pick and pack" as well as labeling, returns management and other "end-to-end" e-commerce management services.

Growing opportunities

DHL is looking to grow in all aspects of e-commerce, from shipment from the manufacturer to warehouse and inventory management to last-mile delivery. The idea is to capitalize on what it sees as significant future opportunities in that sector and a continued upward trend.

Notably, DHL has monitored increases in import and export air freight volumes "approaching double digits" around the world. "The e-commerce space is definitely driving that, along with robust economies around the world," said Paul McMillan, head of sales and marketing for DHL Global Forwarding.

Growth in e-commerce is even altering goods shipment that's evolved over the last decade or so, like the Asia-Americas trade. "By 2020, 25% of China's population will be buying goods online," McMillan contended. "We're expecting trade flows to really start reversing year-over-year as the demand for foreign-based goods in China and across Asia really starts to take hold with consumers."

E-commerce has already become quite pervasive. "Between 95% and 99% of the world's population buys products coming from outside of the local market," said Travis Cobb, senior vice president of Americas network operations for DHL Express. "In the U.S. market, what that means is for our small- and medium-sized customers, we really open up the world and increase their capability to grow their business."

With more deliveries to manage, DHL has also been working to reduce failed delivery attempts. The company's new On-Demand Delivery app gives consumers more flexibility concerning when and how they receive packages, he explained.

With the app, text and email messages keep the customer informed of delivery date, and delivery options include rescheduling delivery date and time and having the shipment left somewhere safe, with a neighbor, at another address or at a service point. The shipment can also be held while the customer is away or on vacation.

The company sees that flexibility as a continued trend going forward and is also partnering with the U.S. Postal Service on last-mile delivery. "DHL Express has been investing significantly in flexible last-mile delivery for our customers, really putting the choice back into their control in terms of how they'll receive that shipment," Cobb said.