Battery-electric vehicles are not the only path to decarbonization for the trucking industry. New research shows they might not even be the most effective path—renewable diesel could be far better.

A new report from the American Transportation Research Institute finds that, for the trucking industry, renewable diesel can outperform battery electric vehicles in vehicle costs, infrastructure costs, and even environmental impact.

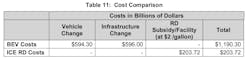

According to the Renewable Diesel—A Catalyst for Decarbonization report, adopting BEV to reduce emissions is nearly six times more expensive than RD. While electric infrastructure and vehicle purchase costs over 15 years could cost $1.19 trillion, sufficient RD subsidies to lower emissions could cost $203 billion.

“This is a big difference,” Jeffrey Short, VP of ATRI, told FleetOwner. “It’s nearly six times more expensive to get the same outcome as far as CO2—and we haven’t even really gotten to the fact that, operationally, the battery electric vehicles to do the long-haul job don’t even exist today. Our scenario assumes that they will exist, but they do not currently, and that is of great concern.”

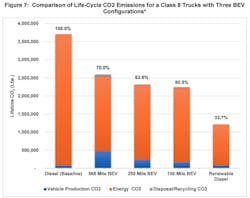

The report finds that RD is not only cheaper to adopt than BEVs—it may also produce fewer life-cycle CO2 emissions per truck.

Previous research on alternative fuels

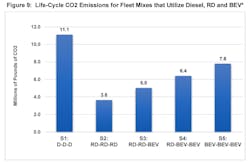

To illustrate this, the authors showed a series of scenarios for a fleet of three trucks, comparing the life-cycle CO2 emissions among petroleum diesel, renewable diesel, and BEV adoption. A fleet of all petroleum diesel had estimated emissions of around 11.1 million pounds of CO2. A fleet using all renewable diesel, on the other hand, had estimated life-cycle CO2 emissions of around 3.6 million pounds. Finally, a fleet of all BEVs would increase CO2 emissions to roughly 7.8 million pounds.

“Each battery electric vehicle is increasing the carbon footprint of this fleet,” Short told FleetOwner. “Effectively, mandates that would move to battery electric from fleets that are already using renewable diesel essentially makes things worse from a carbon perspective.”

Renewable diesel could be cheaper to adopt

The research team also compared the costs of BEV adoption versus RD.

Comparing these costs required multiple layers of possible future scenarios. The team gauged the scale of both decarbonization methods by estimating the lifetime CO2 emissions of vehicles in future truck populations.

In the BEV scenario, 61.5% of the 3.25 million trucks in operation would be battery-electric in 2038, with the remaining 38.5% still using petroleum diesel. The total emissions in this scenario would be roughly 9.82 trillion pounds of CO2—roughly 22.6% fewer emissions than a truck population of entirely petroleum diesel trucks.

To match this CO2 emissions reduction, the study found that only 28.35% of trucks must run exclusively on RD. With the remaining 71.65% of trucks using entirely petroleum diesel, the total emissions would reach only 9.74 trillion. If RD consumption grew by 15.79% annually from 2023, the U.S. could meet this emissions reduction by 2030.

The ease of reducing emissions through renewable diesel, compared to BEVs, shows in the price tag of each scenario.

Pulling data from the Clean Freight Coalition’s electrification cost study, EV adoption vehicle and infrastructure costs could reach $1.19 trillion.

On the other hand, RD is a drop-in fuel chemically identical to diesel—meaning it can be used in existing vehicles and fueling infrastructure. According to the researchers, the costs of RD adoption would lie only in further developing RD production facilities and distribution infrastructure. Estimating a $2 per gallon RD subsidy and facility cost per gallon by 2038, the total cost of the RD adoption scenario would be only $203.7 billion.