Forecast: Pipeline transport to take some of trucking’s freight share

All modes of freight transportation are going to witness an increase in volume over the next decade, according to the most recent forecast by the American Trucking Associations (ATA). However, the volumes moved by pipeline will “grow significantly,” according to the trade group’s analysis, and that will eat into trucking’s share of the freight market.

"We forecast all modes of freight transportation, not just trucking. The reason we do that is that even when freight doesn't go on trucks for the primary portion of the movement, so much of the secondary ones go via truck,” noted Bob Costello, ATA’s chief economists, in a conference call with reporters this week.

“So we always felt like this is something we need to know what the other modes are doing, because we [trucking] often support those modes in that first and last mile, if you will," he said.

The report, entitled ATA Freight Transportation Forecast 2017 and compiled by IHS Global Insight for ATA, indicates that all modes of freight transportation, including trucking, are expected to lose market share through the forecast period to pipeline.

“It is important to note that the loss of market share doesn’t mean that actual tonnage declines for all other modes; in fact, the opposite is true,” according to the report. “However, pipeline tonnage will grow by far the fastest among all the modes, increasing an astounding 137% through 2028, thus increasing its market share.”

"A lot of times I get asked questions like, 'Hey, is pipeline really a mode of transportation?' It absolutely is — because if it doesn't go on a pipeline, it's going to go on another mode, whether it's trucking or rail,” Costello noted on the call. “So pipeline is definitely a mode of transportation, and it's going to be the fastest-growing mode over the [report] period. Rail intermodal will follow that at just under 48% growth over the forecast period."

He added that the trucking industry will experience a “slight decrease” in modal share —going to go from 70.6% of all tonnage in 2016 to 67.2% in 2028 — and most other modes follow at similar patterns.

“Remember, it's not because there's an actual decrease in freight, it's because pipeline is expected to grow so much," Costello stressed.

"Trucking is going to grow overall by 33.6% over the forecast period. Really, all the modes are growing, and growing quite well. Rail carload will be the slowest-growing over that period at 8.2%; you get total rail [growth] at 12.3%,” he said. “That's on the volume side."

On the revenue side, everything looks really good, too, Costello added. “All modes are going to see really good growth here with 89% for all modes combined, ranging from 207% for pipeline down to 43% growth over the forecast period for rail carload," he explained.

Costello touched on a few other key trucking points during the call concerning ATA’s freight forecast:

- When you look at the U.S. economy purely based on demographics and population growth, “you have a mature economy that is going to grow in the low-twos or 2% average over the [forecast] period" to 2028, he said.

- "Baked into these numbers — although they don't give a year-by-year forecast — is that by 2028, I think it's pretty safe to say we're going to have a recession,” Costello noted. “You have to take that into consideration; that would also bring down the averages."

- While he believes there will still be plenty of long-haul truck freight to be had in the future, he stressed that trucking's real “sweet spot” — and why trucks and trains only compete on a fairly limited basis — is that most truck freight doesn't go over 500 miles. “If you looked only at private carriage, that average length of haul is much lower," he noted.

- Total truck tonnage, including for-hire and private carrier operations, hit 10.42 billion tons in 2016, the highest level since 2007. As of last year, total truck tonnage was up 22.3% from the low in 2009.

- Revenue associated with truck transport is projected to reach $719 billion in 2017, an increase of 6.4% versus 2016. Trucking revenues are then expected to reach $988 billion by 2023; an increase of 5.4% per year on average.

- Looking ahead, total freight tonnage is projected to grow 40.4% over the forecast period, while total freight transportation revenue is forecasted to surge 89.1% by 2028.

- Based primarily on IHS Global’s analysis of key truck-oriented commodities, total truck tonnage is expected to increase to over 12.57 billion tons by 2023 and reach 13.91 billion tons in 2028.

- Those tonnage increases translate into annual growth of 2.7% for 2018-2023 and 2% for 2024-2028.

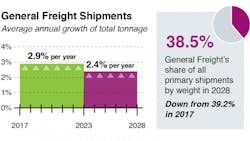

- General commodity traffic is slated to expand 3% per year for 2018-2023 and 2.4% annually for 2024-2028. Bulk commodity traffic is forecast to rise 2.4% per year for 2018-2023 and only 1.7% annually for the 2024-2028 period.

About the Author

Aaron Marsh

Aaron Marsh is a former senior editor of FleetOwner, who wrote for the publication from 2015 to 2019.

Sean Kilcarr

Editor in Chief

Sean Kilcarr is a former longtime FleetOwner senior editor who wrote for the publication from 2000 to 2018. He served as editor-in-chief from 2017 to 2018.