The state of trucking

Trucking has undergone a major transformation in the past five years as fleets have re-examined every aspect of their operations from equipment to business plans. Think about just a few of the major issues fleets have had to address in recent years: evaluating new fuel options, navigating basic changes to safety regulations, a rapid evolution in truck technologies, a slow-growth economic recovery, and the list goes on.

As we approach 2015, it’s an excellent time to step back from everyday business and take the pulse of this critical industry. What does a truck fleet look like today? How is it different from fleets of even five years ago? And what will it look like in five more years?

Our “State of Trucking Report” focuses on four general areas looking at where we’ve been and where we expect to go.

With the Great Recession officially declared over in mid-2009, the state of the economy report finds the gradual recovery of the last five years is finally gathering some steam, especially here in the U.S. The future it outlines for trucking might even be called rosy, with robust growth as trucks continue to dominate the movement of our freight.

The last five years have brought an onslaught of new rules and requirements that have deeply affected trucking operations of all types. While CSA and new hours-of-service rules come to mind immediately as the most important, back in 2010 there were over 40 new federal regulations in some form of proposal. Many have fallen by the wayside and others like electronic logs and entry-level driver training are still in bureaucratic limbo. The good news, according to our state of regulation report, is that while they still may be on the way, the overall pace of truck regulation is expected to slow in the coming years.

Perhaps no area has seen as much change over the last five years as trucks themselves. After years of watching fuel economy drop with each new wave of emissions requirements, 2009 proved to be a tipping point as new technologies recovered that lost efficiency and pushed into new territory for trucks of all sizes. Prices, too, followed. The forecast in our state of equipment report offers encouragement on all sides.

Although they are often underestimated, the societal changes shaping trucking are examined in the final report. If you doubt such a core industry as trucking can be buffeted by changing social attitudes and trends, think about the explosion in e-commerce since 2009, then add employment pressures fueling the nearshoring phenomenon and the shifting demographics driven by an aging population and immigration.

The industry has certainly changed greatly and rapidly over the last few years. But as “The State of Trucking Report” makes so clear, that’s all just been a prelude to the rapid transformation on the way.

Back on the high road

Both our nation’s and the world’s economy have slowly but surely climbed a long hard road out of the depths they fell to when the Great Recession walloped business activity around the globe in 2009.

The global economy—including the very significant U.S. component of it—is now seen as having hauled itself back onto firmer footing. What’s more, it appears on the whole that economic activity here and abroad will gain further and more impressive elevation over the next five years or so.

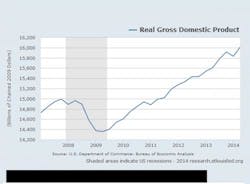

The bottom for the U.S. economy, as pegged by the Federal Reserve Bank of St. Louis, extended from when real gross domestic product (GDP) began contracting in Q3 of 2008 until GDP began growing once more in Q1 of 2010. The Great Recession began in the U.S., per the nonprofit National Bureau of Economic Research, in December 2007 and ran for 18 months, ending in June 2009.

“GDP per capita started expanding in the third quarter of 2009 and reached its pre-crisis level in about four years,” states the “Economic Report of the President,” sent to Congress in March of this year. In addition, that communication contends that “potential real GDP is projected to grow at a 2.4% annual rate” through 2020.

The American Trucking Assns. (ATA) also projects U.S. GDP to improve 2.9% between 2014 and 2019.

World view

According to A.T. Kearney’s Global Business Policy Council’s “Global Economic Outlook 2014-2020,” released in June, the global economy is “finally beginning to stabilize,” leading the firm to “anticipate a return to annual global growth of approximately 3% to 4%” in the 2014-2020 time period.

“Emerging economies will continue to grow in excess of 4%,” the firm forecasts, “while the growth rate of advanced economies [such as the U.S.] is forecast to reach [greater than] 2% for the first time since 2010.”

Indeed, the firm describes what will unfold as a “transitory shift to ‘renewed normal’” for economic activity over the next five years as the global economy is “finally transitioning from the Great Recession to a period of more stable growth.”

As Kearney sees it, higher confidence, increased international trade, and a return to greater investments will drive higher growth around the globe.

“As a result of this economic growth,” the firm points out, “the international flow of goods and capital will surpass their pre-Great Recession levels.”

Kearney says that before the global economic crisis, foreign direct investments (FDI) were primarily directed to advanced economies. These are investments made by a company/entity based in one country into a company/entity based in another.

Then, between ’08 and ’13, emerging markets scored higher FDI in-flows than did the advanced economies. But, looking ahead to 2020, the advanced economies will push FDI growth to more than $2.5 trillion globally.

What’s more, this year will mark a shift back toward advanced economies—with the U.S. at the forefront—leading global GDP growth.

In the 2014-2018 period, says Kearney, advanced economies are expected to contribute more than emerging economies to global growth for the first time since the Great Recession began, marking the birth of that “renewed normal.”

As for the U.S., its economy is stronger going forward, states Kearney, thanks to it being “bolstered by private sector growth, financial sector stability, and rising demand.” There are four key elements underpinning this positive view of the domestic economy: increased stability, improved competitiveness, rising demand, and stronger output.

- Increased stability is being shown by strong financial markets growing credit, the “wealth effect” from greater stability in the housing markets and improved worker mobility.

- Improved competitiveness is being fostered by the country’s “energy revolution,” which is leading to greater cost-competitiveness, as well as by companies “capitalizing on strong R&D with a large, educated workforce and high innovative potential.”

- Rising demand is being indicated by stronger employment that is supporting improved consumption as well as by such other drivers as “repaired household balance sheets” and renewed credit growth.

- Stronger output is being supported by companies increasing fixed investments along with stronger domestic and global demand for durable goods and “slower government fiscal consolidation.”

Policy issues

Kearney also contends that national policies undertaken and the effectiveness of structural reforms initiated by governments will be decisive in determining actual economic outcomes through 2020.

The firm stresses that the economies of the G20 nations, as well as those of other countries, will face “key policy tests” over the next five years in these areas: business environment (including inflexible labor markets and constrictive regulations); educational systems; governance (strong or weak rule of law); income inequality (high levels stifle growth); infrastructure investment; and institutional weakness (governmental bodies unable to carry out their mandates).

According to Kearney, as macro-level fiscal and monetary supports recede through 2020, “growth will be differentiated by the substance of structural reforms and the quality of policy decisions” made by each nation.

“For each country,” advises Kearney, “the key question will be whether the political system can identify and address the hard choices necessary to drive long-term growth.”

Kearney also discusses two caveats that have the potential to impact the global economy: physical climate factors and numerous “geopolitical flashpoints.”

Freight ahead

Zeroing in on the outlook here at home, the latest long-term freight forecast prepared by the ATA in collaboration with IHS Global Insight predicts overall U.S. freight tonnage will rise almost 25%, and revenues from that freight will surge above 70% over the next decade.

The ATA “U.S. Freight Transportation Forecast to 2025” foresees further growth, not just for the trucking industry, but for the entire freight economy, according to ATA chief economist Bob Costello.

“We continue to see growth for the entire freight economy, but we also see that trucking will maintain its position as the nation’s dominant mode of freight transportation,” wrote Costello. “Truck freight generated nearly $682 billion in revenue last year, which is a new record.”

“According to IHS Global Insight,” he continued, “total truck tonnage, including for-hire and private carrier operations, hit 9.68 billion tons in 2013, the highest level since 2008. As of last year, total tonnage was up 13.6% from the low in 2009.”

Costello remarks that “despite the slow [economic] recovery so far, the long-run [freight] outlook still remains bright for nearly all modes.” He adds that key contributors to the projected “robust growth” will involve “many factors,” including trends in manufacturing, consumer spending and international trade.

The report forecasts these highly positive freight developments:

- Overall freight tonnage will grow 23.5% from 2013 to 2025 and freight revenues increase by 72%.

- Growth in overall freight volume is pegged at 2.8% per year from 2014 to 2019, then it tapers off to 1% during the next six years, through 2025.

- Trucking’s share of freight tonnage will increase from 69.1% in 2013 to 71.4% in 2025.

- Rail intermodal tonnage will grow 5.5% annually through 2019 and 5.1% a year through 2025, yet rail market share will shrink from 14.5% of all tonnage in 2013 to 13.8% in 2025.

The report also serves up these positive takes on the road ahead:

- Trucking will increase its share of the freight pool because trucks dominate the transportation of general commodities— and those will continue to grow at a faster rate than bulk commodities. Trucking will also gain from rising U.S. crude oil and natural gas production.

- As demand/production of key truck-oriented commodities improves, trucking’s market share of tonnage should expand to 70.9% in 2019 and to 71.4% by 2025.

- Trucking’s share of total revenue is estimated to reach 81.5% in 2025, versus 81.2% in 2013.

- Truckload volume will expand 3.5% per year from 2014 to 2019 and then by 1.2% per year from 2020 to 2025. This projection reflects the anticipated performance of key commodities and freight-market segments.

- Truckload carriers are seen as increasing their use of railroads to handle intermediate and long-distance trailer hauls through the forecast period.

- Less-than-truckload (LTL) volume is forecast to rise from 145 million tons in 2013 to 177.7 million tons in 2019 and then to 204.6 million tons in 2025, which would translate into an average annual growth of 3.8% from 2014 to 2019 and of 2.5% during 2020 to 2025.

- Private-carrier volume is expected to expand by 3% per year from 2014 through 2019 and then 1% per year from 2020 to 2025.

- The private-carrier share of total transportation volume is forecast to “hold steady at 34.9% throughout the forecast period compared with 34.4% in 2013.

Underpinning the report’s unmistakably upbeat outlook are numerous positive factors that the authors expect will play out in trucking’s favor in the coming years.

“The domestic economy remains the driving force behind the performance of the nation’s freight pool, with foreign trade playing a secondary but significant and growing role,” the report’s authors assert.

What’s more, they contend that “if we are right about the future path of the U.S. and global economy, the nation’s freight pool could grow by 23.5% over the 12 years from 2014 through 2025.”

More specifically, per the report, a “cyclical snapback” in housing and construction from 2014 to 2016 will help support freight tonnage growth of 16.6% from 2014 to 2019. In addition, it notes that general commodities will continue to expand at a faster pace than bulk commodities.

As for the negative factors out there that one would need very darkly tinted rose-colored glasses to miss considering, the authors of Forecast point out that “healthy long-term growth in the United States cannot be maintained without healthy spending on the transportation infrastructure, state-of-the art equipment, and technology.”

They also advise that their forecast “remains vulnerable to shocks to the system, such as a territorial dispute with China involving its neighbors or the United States; a worsening of the already dicey situation in the Middle East; an oil supply crisis that would send crude-oil prices spiraling higher; or [the occurrence of] major natural disasters.”

Regulatory déjà vu

If you were sitting in the audience at the FTR Associates Transportation Conference in September of 2010, you would have had the opportunity to hear former Federal Motor Carrier Safety Administration (FMCSA) Administrator Annette Sandberg discuss the wave of regulations soon to break over the trucking industry.

Anne Ferro had assumed leadership of FMCSA the year before and hit the ground running. By the time she was to leave the post in August of this year, she would be remembered for greatly expanding the agency’s reach and power, but that was still the future in 2010.

So on that September day, Sandberg was, as usual, prophetic about what was to come. She talked about the pending CSA 2010, due to go into effect that December; new hours-of-service (HOS) regulations expected to be published later in the fall that would very likely reduce driving hours and change the 34-hour reset provision; and nearly 40 other new regulations waiting in the wings.

“It is not just CSA 2010 or changes to HOS. It’s also about the new pre-employment screening procedures that began in May of 2010; new entrant regulations put in place in December 2009; EOBR [electronic onboard recorder] mandates; and new entry-level driver training requirements [published in August 2009] due January 2011, just to name a few,” she said.

“You have to look at the regulatory ripple effect from this broad context,” Sandberg added. “If all of these [new regulations] come out on schedule in the next few years, they’ll have a significant impact on trucking.”

Jumping ahead to the spring of 2014 and another industry conference, this time the National Private Truck Council Annual Education Management Conference and Exhibition, you might have been in the audience listening to Richard Schweitzer, transportation law and policy attorney and general counsel for NPTC, providing his annual regulatory/legislative update.

Schweitzer noted that the regulatory and legislative world seemed to be moving “more slowly” or even mired down entirely on several fronts. This was not necessarily bad news for fleets.

One stalemate that concerned fleets, he noted, was financing for the Federal Highway Trust Fund, which was almost entirely broke at the time. He predicted another short-term fix from Congress that would “kick the can down the road” until after the next mid-term election. He was right.

Today, Schweitzer still makes it his business to look behind the curtain of the future at regulations that are perhaps waiting in the wings. Here is his list of probable rulemaking events over the next five years:

- Entry-level driver training standards (now in court; supposedly a negotiated rulemaking to follow)

- Sleep apnea standards for screening, testing, diagnosis, treatment and disqualifications

- Equipment standards from NHTSA (National Highway Traffic Safety Administration) for stability control, lane departure warnings, vehicle integrity

- Revised safety fitness determinations for motor carriers

- Increased minimum financial responsibility requirements

The biggest regulatory area of all, however, he predicts will be “all of the rules relating to driverless, or ‘autonomous,’ vehicles, which eventually will obviate the need for all of the other driver regulations but create a new liability scheme for carrier management.”

Just when you thought the rulemaking extravaganza was almost over, too.

Regulatory timeline: a busy decade

Here are a few action highlights from the past decade of trucking industry regulation. It is worth noting that in 2009 and 2010, government regulation made it into the top three “Critical Issues in the Trucking Industry” list published by the American Transportation Research Institute.

- January 2010: Hours of service (CFR Part 395). FMCSA holds “listening sessions” around the country concerning possible changes to driver hours-of-service (HOS) regulations. They get an earful.

- January 2010: EPA emissions regulation deadline NOx. Engine makers have been working since 2007 to meet new Environmental Protection Agency (EPA) emissions standards for oxides of nitrogen. The industry is almost entirely favoring the use of SCR (selective catalytic reduction solutions--urea) to bring NOx emissions down. The cost of new trucks is expected to jump, but the hope is that fuel efficiency will improve again after the losses caused by adding particulate traps to the exhaust stream earlier. That hope is realized.

- April 2010: Electronic onboard recorders for logging hours of service (CFR Parts 395, 396 and others). Incorporates new performance standards for electronic onboard recorders (EOBRs) installed in commercial motor vehicles manufactured on or after June 4, 2012. Onboard hours-of-service recording devices meeting FMCSA’s current requirements and installed in regulated vehicles manufactured before June 4, 2012, may continue to be used for the remainder of their service life.

- September 2010: Antilock brake systems (CFR Part 393). Makes permanent the existing requirement that trailers equipped with antilock brakes have external malfunction lamps.

- October 2010: Limiting the use of wireless communication devices (CFR Part 383 and others). FMCSA publishes the Final Rule prohibiting texting by commercial motor vehicle drivers while operating in interstate commerce and imposing sanctions, including civil penalties and disqualification from operating in interstate commerce, for drivers who fail to comply with this rule. Motor carriers are also prohibited from requiring or allowing their drivers to engage in texting while driving.

- December 2010: Hours of service (CFR Part 385 and others). FMCSA publishes its Notice of Proposed Rulemaking on hours of service. The administration favors a 10-hour limit, but notes it is still open to input on an 11-hour duty period.

- February 2011: Electronic logs (CFR Parts 395, 396 and others). Under this Notice of Proposed Rulemaking, all motor carriers currently required to maintain Records of Duty Status for HOS recordkeeping would be required to use electronic logs to “systematically and effectively monitor their drivers’ compliance with HOS requirements.”

- April 2011: Harassment (CFR Parts 395, 396 and others). The issue of using electronic logs to harass drivers rears its head and FMCSA initiates a period for public comment, noting that it believes it has addressed harassment adequately in the recently published proposed rules.

- May 2011: Commercial driver’s license testing and learner’s permit standards (CFR Parts 383-385). FMCSA publishes a Final Rule amending the commercial driver’s license (CDL) knowledge and skills testing standards and establishes new minimum federal standards for states to issue the commercial learner’s permit (CLP).

- December 2011: Use of cellular phones while driving ( CFR Part 390 and others). FMCSA issues its Final Rule restricting the use of hand-held mobile telephones, including hand-held cell phones, by drivers of commercial motor vehicles while operating in interstate commerce. There are new driver disqualification sanctions for interstate drivers who fail to comply.

- December 2011: Hours of service (CFR Part 385 and others). FMCSA publishes a Final Rule amending HOS regulations to limit the use of the 34-hour restart provision to once every 168 hours and to require that anyone using the 34-hour restart provision have as part of the restart two periods that include 1 a.m. to 5 a.m. It also includes a provision that allows truckers to drive if they have had a break of at least 30 minutes sometime within the previous eight hours. It leaves the 11-hour limit in place.

- April 2012: National registry of certified medical examiners (CFR Part 390 and others). FMCSA publishes its Final Rule establishing a National Registry of Certified Medical Examiners with requirements that all medical examiners who conduct physical examinations for interstate commercial motor vehicle drivers meet certain criteria spelled out in the regulation.

- May 2012: Electronic onboard recorders (CFR Parts 395, 396 and others). FMCSA “vacates” its electronic logging rulemaking of April 2010 over the harassment issue.

- August 2012: New entrant corrective actions—safety audit failure (49 CFR Part 385). FMCSA publishes a Notice of Policy advising new motor carriers that it must receive a new entrant motor carrier’s evidence of corrective action within 15 days of the date of a safety audit failure notice or within 10 days of the date of an expedited action notice. Failure to comply could result in having the carrier’s registration revoked and being placed out of service.

- August 2013: Retention of driver vehicle inspection reports (CFR Parts 392, 396). This well-intended Notice of Proposed Rulemaking is meant to ease paperwork burdens by no longer requiring that commercial motor vehicle drivers operating in interstate commerce (except drivers carrying passengers) submit, and motor carriers retain, driver-vehicle inspection reports when the driver has neither found nor been made aware of any vehicle defects or deficiencies. That is not the effect.

- September 2013: Entry-level driver training requirements (CFR Part 383 and others). With this notice of withdrawal, FMCSA abandons its 2007 effort to establish minimum training requirements for new drivers and announces its intent to start over anew.

- September 2013: Tank vehicle endorsements (CFR Part 383). FMCSA issues this Notice of Proposed Rulemaking to expand the definition of a tank vehicle in ways that will require more drivers to obtain tank vehicle endorsements on their learner’s permits.

- October 2013: Hours of service (CFR Part 395). Yet another Final Rule on HOS, this action provides an exemption from the 30-minute break provision for short-haul drivers.

- February 2014: CDL drug and alcohol clearing house (CFR Part 382). This Notice of Proposed Rulemaking from FMCSA is intended to create a database under the agency’s administration that would contain controlled substances (drug) and alcohol test result information for the holders of commercial driver’s licenses.

- February 2014: Patterns of safety violations by motor carrier management (CFR Parts 385, 386). This publication makes final a 2012 rulemaking proposal and enables the agency to “suspend or revoke the operating authority registration of motor carriers that have shown egregious disregard for safety compliance or that permit persons who have shown egregious disregard for safety compliance to act on their behalf.”

- February 2014: Sanitary transportation of food for people and animals. The trucking industry is accustomed to regulatory activity by FMCSA and EPA, but this Notice of Proposed Rulemaking from the Food and Drug Administration (FDA) seems to hang just under the radar. It contains requirements for processes and procedures, employee training, recordkeeping and auditing to help assure that food is kept under sanitary and correct-temperature conditions from farm to fork.

- May 2014: Automatic onboard recording devices (CFR Part 395). This Notice of Proposed Rulemaking would make it acceptable to provide information requested by roadside inspectors on a display screen rather than requiring printed or faxed documents.

- May 2014: Coercion of drivers (CFR Part 385 and others). Don’t even think about it. This Notice of Proposed Rulemaking would prohibit motor carriers, shippers, receivers or transportation intermediaries from coercing drivers to operate commercial motor vehicles in violation of certain provisions of the Federal Motor Carrier Safety Regulations—including drivers’ hours-of-service limits, the commercial driver’s license regulations, and associated drug and alcohol testing rules—or the Hazardous Materials Regulations.

- August 2014: Entry-level driver training requirements (CFR Parts 380 and others). It’s back. Initiated in 2007 and abandoned in 2012, FMCSA proposes with this Notice of Intent to conduct a Negotiated Rulemaking on new driver training, involving parties beyond the agency.

Spend to save

For a good example of how the cost footprint of trucking equipment has changed over the last several years, look no farther than Hudson, IL-based TL carrier Nussbaum Transportation Services.

Founded in 1945 and today operating 245 trucks and 600 dry van trailers, Nussbaum has improved its fleet’s fuel economy some 26% since 2010 through a range of vehicle aerodynamic and spec’ing changes married to driver performance initiatives.

Brent Nussbaum, president and CEO, noted at a recent industry meeting that since 2010 his fleet has moved its fuel economy average from 6.5 to 8.2 mpg as of this year. Several of the carrier’s drivers have even achieved 8.81 mpg behind the wheel of new 2014 and 2015 model Freightliner Evolution package Cascadia highway tractors.

Donald Broughton, managing director, senior research analyst and chief market strategist for Avondale Partners, said that such fuel efficiency figures cited by Nussbaum represent a big opportunity for fleets to increase profitability.

“Fuel economy is a major tailwind now. It’s huge,” he explained. “Moving from 6 mpg to 9 mpg over 120,000 mi. per year saves $30,000 in fuel at today’s diesel prices; that’s a 19¢ to 20¢ per mile savings.”

Such savings are critical to help counterbalance the sticker shock suffered by fleets since the implementation of mandated emissions control systems began over a decade ago.

Starting in 2002, about $1,800 to $3,000 was added to the base cost of a Class 8 truck to meet the first round of emissions regulations. For 2007, an extra $5,000 to $10,000 got tacked on to Class 8 sticker prices, followed by another $6,700 to $10,000 extra in 2010 to meet the final round of emissions mandates.

More cost, savings

According to data analyzed by global consulting firm Frost & Sullivan, the average cost of a new tractor-trailer is now estimated to range between $140,000 and $175,000; anywhere from $110,000 to $125,000 for a new Class 8 tractor; and $30,000 to $50,000 for a new trailer, depending on whether it’s a flatbed, dry van, or refrigerated model.

“From 2007 through today, the biggest factor in trucking total cost of operation calculations has been fuel,” explains Sandeep Kar, global director of automotive & transportation research at Frost & Sullivan. “So now, as equipment becomes more efficient and productive, that will balance out the higher acquisition cost.”

“We are certainly seeing better fuel economy for heavy trucks since 2010 as equipment continues to get more aerodynamic and lighter,” adds Jonathan Starks, director of transportation analysis for research firm FTR Transportation Intelligence.

And though the imposition of greenhouse gas (GHG) reduction rules over the next five years will change the equipment equation yet again, this time both the industry and U.S. government regulators will be moving toward the same goal: improving fuel efficiency.

“Though equipment will still get more expensive—there is no doubt about that—the argument can be more successfully made that fleets will be paid back in fuel savings,” Starks says. “That argument couldn’t be made five to eight years ago where exhaust emissions were concerned.”

Starks also stresses that cost increases going forward to comply with GHG rules should be more incremental in nature compared to the larger dollar figures attached to emissions control systems in 2007 and 2010.

Hard rocks

Yet many fleets, especially smaller carriers, are currently stuck between a rock and a hard place of sorts when it comes to buying new equipment.

On the one hand, many skipped several buying cycles to avoid the higher sticker prices for 2007 and 2010 emissions-compliant rigs and now face an accumulation of purchase price increases in one fell swoop. At the same time, the higher costs associated with operating older equipment, especially in terms of lower fuel economy combined with higher maintenance costs and added downtime, put added pressure on a carrier’s bottom line.

Patrick Gaskins, vice president-financial services of AmeriQuest Transportation, notes that tractors today sport an average age of 9.6 years—a near record—leaving fleets with just two options: chase financial savings or fuel efficiency.

“Back in 2006, a base-level day cab tractor cost around $85,000 per unit,” he explains. “Today, it’s around $110,000, an increase of $25,000.”

The fuel economy gains over that same time period can make such a difference to the bottom line that it can “absolutely [be a] key factor” in making the decision to keep or replace, Gaskins says.

“For example, if a new vehicle delivers 8 mpg vs. the 6 mpg of the existing vehicle, that 2 mpg difference can be extremely significant,” he explains.

“If a tractor runs 120,000 mi. per year and diesel costs $4 per gallon, that 2 mpg increase in the new asset can equate to a savings of 5,000 gals. of diesel per year, equaling $20,000 in fuel savings annually,” Gaskins says. This more than offsets the higher acquisition costs.

With the accumulation of lower annual mileage, Class 6 and 7 trucks are witnessing similar cost benefits from improved fuel efficiency, he stresses, and those gains are projected to continue over the next five years as new specifications are established to comply with GHG rules.

“Some of the trucks we’re seeing today can achieve 8 mpg and even 10 mpg,” Gaskins says. “That’s a big change to the baseline expectations for fuel economy. So one of the points I like to make is that if the OEMs delivered a truck that could average 12 mpg, even at a [purchase] cost of $200,000, the fuel savings still make it work.”

While he notes that it’s “impossible” for a fleet to replace all of its aging vehicles at once, Gaskins says carriers should conduct a “fleet performance analysis” to identify the “order of replacement” for current equipment based on historical fuel economy costs, maintenance and repair costs, usage patterns, fixed financing costs, and acquisition and disposal trends.

“Deciding which vehicles to keep and which to replace can require painstaking calculations and research,” he warns. “But there is a perfect point, sometimes referred to as the sweet spot, when it costs less to replace a vehicle than to keep it. Target those vehicles which qualify as the first vehicles to replace.”

Even for smaller fleets, such comprehensive fleet performance analysis routinely reduces fleet operating costs by 15% to 20%, Gaskins explains.

Frost & Sullivan’s Kar feels that such equipment cost reductions could increase over the next five years, depending, of course, on the progression of remote diagnostic offerings and how data gleaned from such technology is used to reduce maintenance costs and vehicle downtime.

“The total benefit available from ‘soft’ technology trends really isn’t there yet,” he explains. “Since 2007, only two components—the engine electronic control module and tire pressure management systems—have been linked to telematics to offer up the kinds of prognostic repair capabilities fleets are seeking.”

Small vs. large

Almost every component on a Class 8 truck today—from brakes, wheels, and axles to the transmission—are monitored by some sort of sensor array. “So the real benefit is going to come when every vehicle system is connected to telematics, and that is what will truly revolutionize truck maintenance,” Kar says.

FTR’s Starks cautions that there will be a dichotomy within the fleet world over the next five years between those who can afford to make the equipment upgrades that will, in turn, deliver all of those savings and those who can’t.

“The large fleets still have access to low-cost capital so they can right-size and modernize their operations fairly quickly,” he explains. “That leaves the smaller fleets trying to play catch-up. Now, if freight demand stays strong and they get the rate increases they need, they will be able to afford to buy newer equipment.”

But if they don’t, they will struggle more than most because the preponderance of all the old equipment is on the small fleet side of the trucking industry.

Outside influences

Back in 2009, most trucking companies were only concerned with survival. Fighting through the worst economic downturn since the Great Depression, executives focused most of their attention on the here and now and not on what might become. Sure, the industry was about to get hit with the 2010 EPA emissions regulations, but that was just one change coming.

Hard-hit retailers, in particular, were trying to find their footing as consumers stopped shopping in stores and started adopting a new wave of purchasing power—e-commerce. Up until that point, most Americans might have thought that e-commerce was simply a misspelled word, but technology helped change that. To accommodate the new shopping world, retailers started changing their distribution patterns. Add in an economy that has grown steadily, albeit slowly, from its nadir, and suddenly truck fleets had more to worry about than just the increasing costs of equipment.

A state of change

More freight meant the need for more drivers and more trucks. Changing freight patterns meant reworking supply chains. It was an industry in change at a time when many fleet owners were still trying to figure out if they would survive the Great Recession.

There are plenty of outside influences that have affected—and will continue to affect—trucking, making it difficult to pick just a few. But one of the most important has been the changes in distribution.

A couple of trends are affecting the industry, led by the push to bring manufacturing back to North America after years of job outsourcing. The nearshoring and reshoring movements are still in their early stages, though. Both terms refer to the movement of manufacturing from overseas into the U.S. or nearby locations such as Mexico.

For years, U.S. companies shipped jobs overseas because labor and production was cheaper. That trend is starting to turn. In 2013, the AlixPartners “Manufacturing-Sourcing Outlook” found that the U.S. had reached “parity with Mexico as a preferred nearshoring location.” Also, 37% of respondents said their preferred nearshoring location would be the U.S.—the same percentage that said Mexico, the report noted. “This continues a trend seen over the past two years of the U.S. closing the gap with Mexico.” In addition, the report said the U.S. appears to be close to “cost parity” with China, which may occur as early as 2015.

At this point, the continued increase in nearshoring and reshoring is quite dependent on U.S. tax policies. Should tax law changes reduce the effective tax rate of corporations, more jobs may come back stateside. If overseas profits remain untaxed, or lightly taxed, jobs may stay overseas.

What does this mean for trucking? As more manufacturing is handled stateside, more raw materials must be moved. With trucking moving about 70% of all goods—and 55.4% of all trade with Canada and 65.4% of all trade with Mexico, according to the American Trucking Assns. (ATA)—the increased growth in freight will further tighten capacity.

In love with shopping

The other big freight growth driver for trucking is the continued love-affair Americans have with e-commerce shopping. Online purchasing, led by Amazon and now being adopted by most major retailers, has grown more than 100% in the past five years. Growth is expected to continue, increasing from $263.3 billion in 2013 to $491.5 billion by 2018, according to eMarketer. Much of that growth will be led by computer and consumer electronics.

That growth will influence freight delivery and freight patterns. Most e-commerce purchases are handled by less-than-truckload carriers and package delivery companies and as companies open additional distribution facilities to speed product delivery, it is also affecting fleets and drivers. In the e-commerce model, explains research from Stifel, Nicolaus & Co., product is shipped via truckload or intermodal to local fulfillment centers and then final delivery takes place via package delivery or smaller, regional carriers. That is beginning to open up the more desirable local driving jobs.

But even that, though, has not been enough to put a dent in the growing driver shortage, estimated by some at 30,000 or more currently and only expected to get worse, according to the ATA. In response, carriers have started raising wages. The American Transportation Research Institute says driver wages have increased 2.3¢ per mile and driver benefits have increased 1.3¢ per mile from 2008 through 2013. Those will only go up in the next five years as more drivers will be needed to move an increasing amount of freight.

Women & minorities

The U.S. government projects that 330,000 new truck drivers will be needed to meet freight demands by 2020. Total U.S. freight tonnage is expected to increase 23.5% by 2025, ATA said. Five years ago, in the midst of the Great Recession, a driver shortage barely registered. Today, though, it does. But raising driver pay is not the only answer to get more drivers. Neither is more home time. Many fleets are coming to realize this isn’t only an issue of economics. “When I think about it, I think about how maybe the lowest paying carriers are paying $40,000 and the highest paying carriers are paying $80,000,” John Larkin, managing director & head of transportation capital markets research for Stifel, recently said. “In the oil field [industry], it’s probably $100,000 to $120,000. Yet the people paying $80,000 per year to their drivers are still struggling.”

So where are the drivers now and from where will they come? “There is a driver shortage in the U.S., in part because the blue collar workforce is shrinking rapidly and because our society has moved from a focus on goods and products to services,” Larkin explained at a recent conference.

To find drivers, two areas that the industry might turn are immigrants and minorities. As of 2012, 34.5% of drivers were minority, but only 5.4% were women. Back in 2004, a report from Global Insight suggested that the whole male population, which still makes up the bulk of the driver population, would “decline by over 3 million persons between 2004 and 2014.” That should necessitate the opening of the door to more minority and female recruiting. Ellen Voie, founder of the Women in Trucking Assn., suggested in a recent Fleet Owner IdeaXchange post that carriers need to be more aggressive in recruiting women.

“Trucking company executives often tell me that women are better at completing their paperwork and often treat their equipment better than their male counterparts. Regarding communication, women are often viewed as being better with customers as well,” she wrote, adding that more driver-friendly trucks are one solution.

“The length of haul is getting shorter and time at home is viewed as crucial in attracting and retaining drivers,” she continued. “Adding women to the driver pool is not just something we should do to fill a need; it’s something we should be doing because we have an opportunity to utilize under-represented potential.”

According to the Bureau of Labor Statistics, the average age of a truck driver today is 55. The American Society for Training and Development (ASTD) has studied Generation X and Millennial workers and found that they put more value on work-life balance and technology than previous generations. With close to 77 million Baby Boomers expected to retire within the next 15 years and only 46 million new people entering the workforce, ASTD said, finding the next generation of truck drivers is only going to become more difficult.

Immigrant influx

Immigration has been a hot-button issue for years and has grown increasingly political recently as more than 50,000 children, most from Guatemala, Honduras and El Salvado, have entered the U.S. seeking asylum. But immigration is more than just children, and it has had a profound effect on business, particularly trucking.

President Barack Obama promised an immigration reform bill as part of his second term in office, and while Republicans and Democrats agree something should be done with the millions of illegal immigrants in the U.S., the two sides have, as of yet, gotten together to develop a comprehensive plan going forward.

Should one be worked out, the legal workforce could see an influx of millions of people and that could be a boon for trucking.

The Congressional Budget Office (CBO) predicts U.S. population growth of 4.3% by 2018 due to immigration alone. And that doesn’t factor in the 11.5 million illegal immigrants awaiting permanent status today. Passage of an immigration reform bill could add millions of additional immigrants, CBO said.

With a new labor force, it’s possible that both driving and non-driving jobs could be filled. And the influx could also create competition for jobs, helping keep wage and benefit costs in line.

Shorter hauls

As mentioned, another change that is taking place is the addition and relocation of distribution centers to both create shorter routes for drivers and also to get product into the hands of consumers quicker. That is mirroring a migration shift in the country that is seeing more people move into densely populated

areas where job growth is occurring, Stifel noted. As of 2013, half of the U.S. population now lives in just 145 counties clustered in four primary areas: the Pacific Northwest, Southern California, Florida and the Northeast.

From 2008 through 2011, it was Texas, North Carolina and Florida that saw the most growth in population. As the population moves from one place to another, that puts a strain on local infrastructure and logistics operations, which must be adjusted.

And while all of these items—immigration, freight distribution, e-commerce—will play a significant role in shaping trucking for the next five years, the one thing that may do more to shape what trucking looks like going forward has little to do with the business of operating trucks. It is the industry’s public image.

In this day and age, when politicians seemingly have more interest in pleasing the public without attaching their name to legislation that might not get them re-elected, it is becoming fashionable to jump on the latest public cause—and the latest cause is distracted driving. What began a few years ago as a crusade to curb accidents due to phone use while driving has morphed into a cause célèbre that has enveloped trucking and hours-of-service regulations. Industry concerns are no longer just industry concerns.

The public image of the industry and its drivers is an issue that has drawn attention from mainstream media outlets, which ratcheted up the calls to get dangerous truckers and unsafe trucks off the roads following the widely publicized June crash involving a Walmart tractor-trailer and a vehicle with several people inside, including actor Tracy Morgan. One person was killed and Morgan was seriously injured. But for critics of trucking, it was the kind of accident they needed to increase the pressure on the industry.

To shore up the industry’s public image, a coalition of groups got together and formed Trucking Moves America Forward (TMAF), an effort by the industry to “inform policy makers, motorists and the public about the benefits of the trucking industry to help build a groundswell of political and grassroots support necessary to strengthen and grow the industry.”

A special industry

“Today’s modern truck drivers are skilled professionals and devoted family men and women, trained to focus on safety, efficiency and reliability while operating the safest and most sustainable trucks we have seen to date,” Steve Ponder, chairman of TMAF, and vice president of Great West Casualty Co., said at the official introduction of the group at the Mid-America Trucking Show in March.

“Trucking is an important industry to our country. Nearly every consumer good touches a truck along its journey, and we are excited to share what makes trucking so special with the American people,” he added.

To those within the industry, it is considered an effort that is long overdue. But it is an effort that over the next several years may flip the image of dirty trucks and unsafe drivers. And if successful, it could ease the pressure trucking faces on a daily basis from customers, the public at large, and even Washington regulators.

Trucking would love to roll into that future.

About the Author

Jim Mele

Jim Mele is a former longtime editor-in-chief of FleetOwner. He joined the magazine in 1986 and served as chief editor from 1999 to 2017.

Wendy Leavitt

Wendy Leavitt is a former FleetOwner editor who wrote for the publication from 1998 to 2021.

Sean Kilcarr

Editor in Chief

Sean Kilcarr is a former longtime FleetOwner senior editor who wrote for the publication from 2000 to 2018. He served as editor-in-chief from 2017 to 2018.