Volvo Trucks North America (VTNA) still sees North American Class 8 truck sales of 240,000 this year — which an exec said is "more normal" following a banner year in 2015 — but next year, the number will dip somewhat lower, the OEM predicts, noting a few additional trends.

"You know about last year, which was fantastic with over 300,000 [Class 8] units sold across North America," said Magnus Koeck, vice president of marketing and brand management at VTNA. And while the industry could "easily get used to" such numbers, he noted that that expectation was what led truck OEMs to continue higher production rates into a market slowdown, which built up inventory on dealers' lots.

"There's still a lot of inventory out there at the dealers," Koeck said, speaking at the company's first Safety Symposium held at the Michelin Laurens Proving Grounds in Laurens, SC. "That's the major impact we've seen on new orders for the industry. We are seeing those inventories coming down, but they will probably be out there for at least this year and probably into next year, and then we may see an upturn in the market."

Even with a slight increase in sales over the summer, going forward, "we believe there will be a 215,000 total [Class 8] North American market next year," he added. "We believe it's going to continue to decline a little bit."

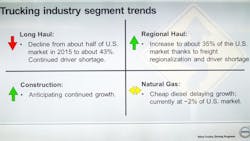

With VTNA's core business segments — long haul and regional haul — the company continues to observe a shift from the former to the latter in the North American market. Regional haul rose from 27.7% of the North American market last year to about 29% this year, and VTNA believes that will grow to about 35% in the near future.

Long haul, Koeck noted, dropped from 50.4% of the North American market in 2015 to about 46% for this year, and VTNA sees that continuing to settle to about 43%. It's due mostly to continued driver shortages and shifting distribution models, he added, and so far not from the Panama Canal being opened up this year to allow large container ships through.

VTNA has also seen an uptick in the construction sector this year by about 3-4%, which has boosted sales a bit although it's "not our strongest segment," Koeck said. The company predicts that trend will continue in the coming years.

And as far as the fuel behind heavy trucking, not surprisingly, it's diesel, diesel, diesel, and VTNA believes that won't change anytime soon. Koeck noted that the U.S. Dept. of Energy expects diesel prices will climb at a rate of 2.2% annually through 2040.

While crude oil and diesel prices indeed have increased a bit in the second half of 2016, "diesel is still cheap," noted Koeck, and that has held back growth in natural gas. That alternative fuel powers about 2% of the North American heavy trucking market, and VTNA believes that will stay about flat for the time being.