House supports effort to block increase in carrier insurance minimum

In a vote only a parliamentarian could love—a vote that confused at least one congressman—the House on Thursday blocked an amendment that would have blocked an amendment that blocks any increase in the minimum financial responsibility requirement for motor carriers.

The vote, largely along party lines, came during floor debate over the annual appropriations package for the Transportation and the Housing departments (HR 2577), also known as the T-HUD bill. The bill includes a number of “policy riders,” or legislation attached to the spending plan that could impact the trucking industry.

Along with the carrier insurance rider, T-HUD includes language that would extend a suspension of the restart rules contained in the 2013 change in hours of service and permit twin 33-foot trailers on Interstates.

Democrats, at the committee level, tried to repeal the pro-trucking riders but the Republican majority consistently rejected those attempts.

As the bill moved to the House floor this week, the Owner-Operator Independent Drivers Assn. anticipated another try to repeal the carrier financial responsibility rider and called on its members to contact their representatives in Congress.

OOIDA contends that the current minimum of $750,000 covers 99.9% of truck-involved accidents that result in property and personal industry damages. Additionally, any significant increase in the minimum threatens the viability of small business truckers.

This comes as the Federal Motor Carrier Safety Administration (FMCSA) last fall issued a notice of proposed rulemaking calling for public comment on the matter. Along with the NPRM, FMCSA filed documentation that makes the case that amount, which has not been changed for 30 years, has not kept up with the marketplace.

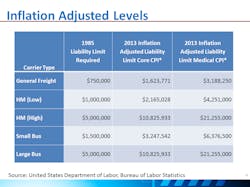

An FMCSA-sponsored study by DOT’s John A. Volpe Transportation Systems Center showed that simply keeping up with inflation would put the minimum at $1.6 million, or even more, $3.2 million, to keep up with rising medical costs.

But “Congress never intended financial requirements to be tied to increases in medical inflation or to cover the worst-case crashes, and the legislative and regulatory history on that is clear,” OOIDA Executive Vice President Todd Spencer said in a statement. “In a worst-case crash, FMCSA’s own report admits that there is no requirement high enough to cover all damages. But there may be other ways to address covering the damage costs of catastrophic and worst-case crashes.”

The House voted 176 for, 247 against to defeat the measure, according to the recorded floor vote, but Nebraska Republican Adrian Smith reported to the chair that he mistakenly voted in favor and asked his vote be changed, as reflected in the Congressional Record.

The introduction of T-HUD amendments will continue next week. The White House announced a likely veto of the bill when it was passed out of committee, however, objecting both to the Republican spending limits and to the specific motor carrier language “that would undercut public safety.”

About the Author

Kevin Jones 1

Editor

Kevin has served as editor-in-chief of Trailer/Body Builders magazine since 2017—just the third editor in the magazine’s 60 years. He is also editorial director for Endeavor Business Media’s Commercial Vehicle group, which includes FleetOwner, Bulk Transporter, Refrigerated Transporter, American Trucker, and Fleet Maintenance magazines and websites.