New study focuses on timeline and cost of autonomous trucks

A new study issued by global consulting firm Roland Berger estimates that the technology required to fully automated heavy-duty trucks will add some $23,400 to their current price tag and that some form of “government support” may be needed to help fleet operators defray that additional expense.

“Governmental support will play a key role in the introduction of automated trucks,” Stephan Keese, Roland Berger’s senior partner-automotive for North America, explained to Fleet Owner.

“As the cost benefit for fleet operators isn't strong enough to create sufficient pull, government funding can become a key driver,” he pointed out. “The timeline, however, also depends on the legal framework.”

Some of the “legal hurdles” outlined in the company’s 45-page study include establishing a “clear definition of liability” in terms of operator versus manufacturer, with responsibilities to be clearly defined in case of automated driving system failure.

In terms of additional cost, the firm only expects 15% to be derived from “incremental hardware” needs, such as the addition of short- and long-range radar systems, front- and side-view cameras, plus automated steering control, to name just a few.

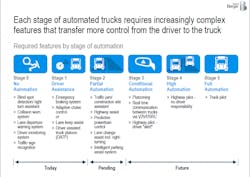

The bulk of the additional cost – some 85% – results from the need for highly advanced software programs designed to replace a “driver’s sensory capability” behind the wheel.The most expensive “stage” of the truck automation process, out of the five stages (at right) identified by Roland Berger, will be ‘Stage 3,” which represents “conditional automation” in trucks in order to operate within platoons as well as pilot themselves in certain highway scenarios.

That stage represents an incremental cost of around $6,200, according to Roland Berger’s estimates – costs that fleets should be able to recoup through fuel savings and safer operation.

“We expect significant benefits from improved safety” at Stage 3, Keese said. “Our detailed analysis shows that incremental costs per stage range from $1,800 to $6,200 per truck and Stage 3 has in fact the highest cost increase.”

The cost savings for fleets, though, will come mainly from accident avoidance, he stressed. “We also expect insurance premiums to go down and see this as one driver for market penetration, besides fuel cost and driver cost savings,” Keese added.

He added that platooning should allow for some cost savings in Stages 1 through 3 in long-haul and regional operations with high traffic volumes, with additional savings in Stage 4 as drivers should be able to rest during automated driving and thus be able to log more miles without taking a break.

About the Author

Sean Kilcarr

Editor in Chief

Sean Kilcarr is a former longtime FleetOwner senior editor who wrote for the publication from 2000 to 2018. He served as editor-in-chief from 2017 to 2018.