Car-service apps like Uber and Lyft are growing in popularity, as the immediacy of being matched with a vehicle via the speed and payment efficiency of a smartphone is a winner in the eyes of many.

However, can the “Uber model” offer similar benefits in terms of matching freight with available truck capacity? Are new entries like Cargomatic and Roadie squeezing out more traditional players such as DAT?

The industry may be in the process of finding out.

From a carrier

Chad Boblett, owner of Boblett Brothers, has always depended on traditional load boards as the chief source of his livelihood.

Boblett mainly uses DAT Solutions, but he has also used TruckStop, an online freight-matching company and load board, which he said is similar to DAT. He started using DAT five years ago, and what he likes most about it is he can post his truck on the load board and brokers will call him to negotiate a price.

“Instead of calling the broker and begging for a load, I post my vehicle and the broker calls me,” Boblett told Fleet Owner, adding that he helps other owner-operators get the best possible rates through a Facebook group he created called Rate Per Mile Masters. “I’m not good at begging people for loads, but I’m good at negotiating my service.”

Since he started his Kentucky-based business, Boblett hasn’t branched out to use other services besides the more traditional load boards – though he’s willing to consider other alternatives for supplemental income.

One problem he’s encountered with traditional load boards is finding shipments after hours – something Boblett wonders if an “Uber-for freight” style app could solve for him.

“I would love to use it,” he said. “I love the creativity, and I love the idea of doing something like that with Uber-for-trucking. I see a lot of benefits for it and opportunity with it.”

Uber-for-freight

Uber, founded in 2009, is a taxi service that allows customers to use a smartphone application, or “app,” to catch a ride with an independent contractor. Prices are typically standard – at times demand-based – and automatically charged to the user’s credit card.

In the trucking arena, similar apps matching carriers with shippers and touting “neighbor-to-neighbor” load movement plus “paperless efficiency” are beginning to pop up more frequently.

“They had zero capacity available,” Parker explained to Fleet Owner. “Most of the work was done in the local space and done by small mom and pops – independent owner-operators. We saw that there was inefficiency in the marketplace, and we saw that there was a need.”

For shippers, Parker – who said he “grew up” in the trucking industry – found they couldn’t really find trucks, and when they did, they weren’t the most efficient truck options.

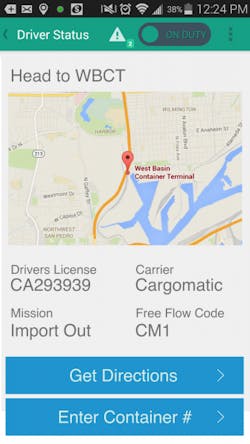

Cargomatic currently serves Southern and Northern California and the New York metro area. Any carrier who has valid operating authority and cargo insurance can potentially be an approved carrier for Cargomatic, the company said. The company also offers free training on the technology provided to new carriers, Parker noted.

Then there is Roadie, which calls itself a “neighbor-to-neighbor” shipping network. It is an app-based community that utilizes excess capacity in passenger vehicles, connecting people with freight already heading in that direction.

“We ship local and long haul, same day, next day and even on weekends,” Marc Gorlin, Roadie’s founder and CEO, told Fleet Owner. “While others are essentially on call and make trips solely for fulfilling demand, we optimize the existing cargo capacity that is already on the road. We are not creating the shipping lanes; we are more efficiently leveraging the pathways and transportation routes already happening all over the country.”

The original Uberization of trucking

DAT Solutions, a freight matching business that was established in 1978 as Dial-A-Truck load finder service, touts itself as being the first company to develop the idea of matching up loads to be moved by carriers with empty trucks.

Eileen Hart, DAT vice president of marketing and corporate communications, said load boards are the original “Uberization” of truck freight.

“Even though we’ve been around for years, we evolve how much data we bring to users in the freight load market place,” she explained. “For us, it’s about bringing our users great information so they can make better decisions and get around more efficiently. The things we see in ‘Uber-style’ apps are things we’ve been doing for a long time.”

Hart and Ken Harper, DAT’s director of marketing, addressed the concerns regarding carriers’ credentials that may arise with newer apps, noting that the apps would most likely work better locally than for long-haul trucking.

“The brokers and the shippers are the ones who have to entrust their freight to somebody,” Harper noted. “I think it’s one of those hurdles you have to get past to become more than a local phenomenon. If you’re hauling freight that has a high retail value, in order to carry that kind of freight, the carrier has to demonstrate that he or she has the credentials and the levels of service that the freight can be trusted to them.”

In order to be included on DAT’s load board, Harp emphasized that the company checks driver credentials and runs background checks.

“A growing challenge for the trucking industry is these growing rings of people who are out there stealing loads and committing fraud,” he added. “One of the things DAT spends a great deal of time making sure of is that people using our network and our apps have the authority to carry freight.”

DAT also offers an app called MyDAT, which provides parking, load information, and other services for drivers on the road. Owner-operators and carriers can also access a number of nearby DAT extended network loads through the app.

Trucker Path is another company with an app to help carriers find loads called “Truckloads.” To find a load, the firm said carriers open the Trucker Path web-based client in their browsers and scan available loads using various search parameters. Or truck drivers can use the Trucker Path app to scan the surrounding area for new truckloads or view them in a list.

The drivers or fleets then make an offer on the available loads, Trucker Path noted; triggering the negotiation between the driver or fleet and the shipping party, during which the customer can see the trucker’s safety rating.

Vetting and payment

The big worries about freight matching apps center on how carriers get “vetted” and in turn how they and their drivers, get paid.

There’s quite a bit of money potentially at stake here, too, as recent analysis by Frost & Sullivan indicates “Uber for freight” could be a $35.2 billion market in North America by 2025.

In terms of securing “Uber-for-freight” shipments, Cargomatic’s Parker noted that his company collects carrier insurance and operating authority data, getting notified if insurance coverage lapses or changes.

He added that every shipment via Cargomatic’s app gets rated as well.

“So if the trucker gets a poor score, we know about it,” Parker emphasized. “If it comes to a point where the carrier can’t be fixed or isn’t reliable, we de-authorize them.”

He stressed, too, that Cargomatic wants carriers to be able to rate the shippers as well. “If they are unable to load, we want them to report it,” Parker noted. “We are trying to add the best revenue to their trucks. If these guys get 100 extra dollars a day on their truck, that’s a big deal.”

He also stressed carriers know exactly what they will be paid upfront via this system, with Cargomatic setting the market price.

“A carrier will see it and accept it if that’s something they want,” Parker explained. “If it’s a good price, they take it, if not, they pass. They get paid very quickly – in approximately 13 days right now. And they don’t have to send an invoice. We pay them electronically through their account.”

Similarly, Roadie’s Gorlin said his firm conducts background checks and depends on driver ratings and reviews.

“Roadie takes data security very seriously,” he noted. “Should any issues arise, we have a 24/7 customer support team available to help.”

He added that drivers are paid via direct deposit into their bank account only after a gig is successfully completed.

About the Author

Cristina Commendatore

Cristina Commendatore is a past FleetOwner editor-in-chief. She wrote for the publication from 2015 to 2023.