The road to hell is paved with good intentions.

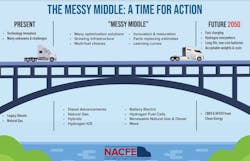

That age-old proverb can feel modern for fleets and trucking leaders facing transportation’s powertrain transition. While the road to zero emissions is based on good intentions, it can feel like hell for those stuck in the middle. If you want to be more positive, it is, at best, "messy," if you ask the good people at NACFE.

As truck and engine manufacturers create more ways for fleets to decarbonize—there are more natural gas and biofuel transportation solutions than ever before—regulators are still more focused on absolute zero.

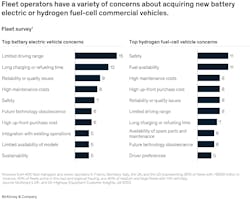

“Adopting these fuels marks a positive step toward sustainable commercial mobility but represents only an intermediate step toward zero-emission mobility in the commercial sector,” according to authors of a recent McKinsey & Co. study on the global path to carbon-free trucks. “Meanwhile, true zero-emission mobility in the form of electric or hydrogen-based trucking appears to be stuck in traffic as massive challenges delay adoption.”

See also: Is GHG3 an EV mandate? Almost.

Physicists say it’s impossible to reach their form of absolute zero, which is the lowest conceivable temperature. Trucking leaders might feel the same about winning transportation’s race to zero emissions. We’re stuck in what the North American Council for Freight Efficiency calls the “messy middle” because there is not one best solution for every fleet duty cycle.

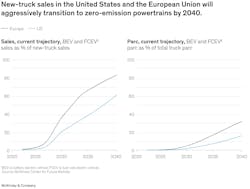

Depending on the segment, the U.S. Environmental Protection Agency wants 25% to 60% of new-truck sales to be zero-emissions equipment by 2032. Meanwhile, the California Air Resources Board’s Advanced Clean Trucks regulation is even stricter, pushing for 30% to 50% ZE sales by 2030.

“This appears to be a daunting task, given that zero-emission trucks—battery electric vehicles and fuel-cell electric vehicles—account for less than 2% of new medium- and heavy-duty truck sales in the U.S. and the European Union, with the largest sales numbers in use cases focused on regional and urban applications for heavy-duty trucks,” the McKinsey authors wrote.

They added: “While ambitions are high, the systems in question do not always work in the needed ways.”

While California and the federal government, through the Inflation Reduction Act, offer tax credits to early zero-emission adopters, these ambitious good intentions coupled with the unbending push of Pollyanna bureaucrats are not enough to transform U.S. trucking, which is responsible for more than a quarter of greenhouse gas emissions in the U.S.

Trucking wants to burn less fuel and be more efficient, but the government’s obsession with electric batteries and hydrogen ignores the incremental emission-reducing potential of biofuels and natural gas. As I’ve argued before, regulators want to force the market to adopt unproven technologies instead of letting the market dictate which clean and near-clean technologies are actual winners. That is a potentially catastrophic way to govern an industry that drives the U.S. economy.

“Ultimately, what is required is a functioning market and an ecosystem that does not rely on regulatory enforcement or subsidies,” the McKinsey authors found. “Fleet owners must want to buy zero-emission trucks, not be forced to buy them because no alternatives exist or because subsidies drive the decision. To achieve this, the ecosystem must improve on the two main buying criteria for fleet owners: the reliability of the ‘infrastructure vehicle system’ and TCO parity versus current powertrain alternatives.”

See also: A high-def history reminder as we focus on the future

Make no mistake: Today's tax incentives are a positive boost for early-adopting fleets and the manufacturers spending research and development time and money on creating clean transportation. However, this transformation needs to be market-driven for it to succeed. While fleets can’t continue relying on government subsidies to ditch diesel for electricity and hydrogen, the OEMs also can’t rely on governments to fund well-intentioned science projects if fleets don’t have the infrastructure to support goods movement.

The U.S. economy relies too much on the trucking industry for this transformation to create more problems. Because right now, according to the McKinsey study, “the market for zero-emission trucks is not working properly, leading to delays in the transition.”

McKinsey analysis found that ZE trucks have up to a 40% TCO disadvantage compared to long-haul diesels. Using medium- and heavy-duty EVs for regional transportation can improve those TCO comparisons, but they still pale in comparison to diesel.

While this study highlights the challenges, it’s far easier for researchers (and trucking editors) to pinpoint all the problems with the government’s decarbonization push. It’s a lot harder for the big fleets that test zero-emission equipment and engineers who are developing the future of transportation to turn these problems into solutions.

Anyone can sit back and point out how hard it is to do something new. We still need more clarity on what is possible, and I hope NACFE helps provide that next year. Its next Run on Less study turns its attention to the messy middle to give the industry more clarity on how early-adopting fleets are paving the road with actual returns on investment.

The 2025 NACFE Run on Less will study trucking’s long-haul segment, including trucks that return to base and those in over-the-road duty cycles. Mike Roeth, NACFE’s executive director, said it would feature fleets deploying Class 8 day cab and sleeper trucks with various alternative fuel powertrains and the best energy efficiency technologies.

“We all know that there are a lot of solutions for decarbonizing longer-haul freight, and NACFE is going to take that head-on,” Roeth told me this summer. “We feel it’s our responsibility to help the industry figure out what’s available now, then soon, and into the future.”

The Run’s results, including reports, documents, and videos, will be published at RunOnLess.com. Currently, NACFE seeks fleets and OEMs to participate in its fifth Run and sponsors to underwrite costs. Contact information is available on its website.

“I am excited that we are going to highlight a variety of ways for fleets to lower emissions in the very challenging long-haul segment of the trucking market,” Roeth said.